Due to her expensive tastes, active lifestyle, and fear of managing money, Sandra Hanna was rapidly depleting her savings and running up a debt despite her well-paying job as a public relations manager in Vancouver.

That was two years ago. Today, with her debt paid off and money in a retirement savings plan, Ms. Hanna, 27, has reversed her downward financial spiral and is shopping for a condo.

Her success came from keeping a clear focus on goals, developing smart money strategies, and relying on the moral support of good friends in overcoming mistakes and challenges.

Those were the key ingredients of a money club that Ms. Hanna and four debt-ridden friends started in March 2006, inspired by the Debt Diet series, Oprah Winfrey’s show on personal finance.

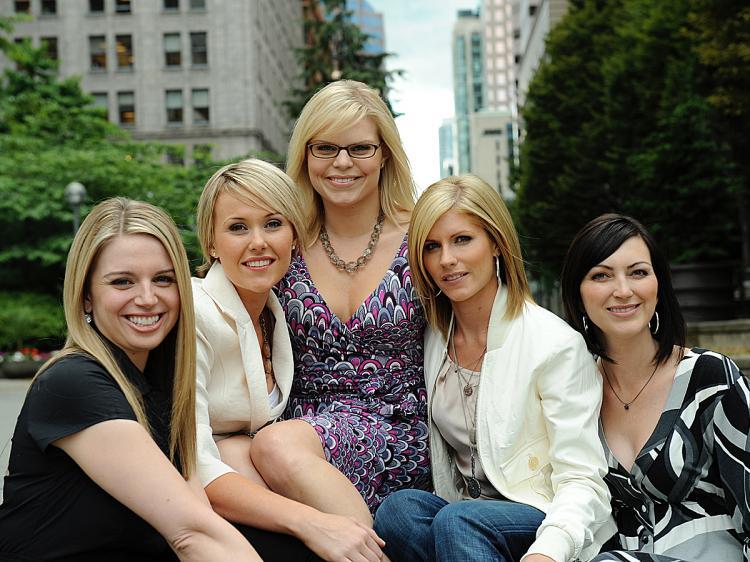

Dubbing themselves the Smart Cookies, the friends’ success led to a bestselling book, a TV show, and speaking tours on making money management “easy and fun.”

Ms. Hanna and Andrea Baxter, Katie Dunsworth, Robyn Gunn, and Angela Self, who range in age from their mid-20s to early 30s, called their book The Smart Cookies’ Guide to Making More Dough. The book’s tagline? “Be smart, be rich, be fabulous.”

Since starting the money club, the cookies have reduced their collective debt of $55,000 to $10,000, and their monthly miscellaneous spending from $10,000 to $3,000. Meanwhile, their annual combined salaries have grown from $275,000 to $415,000.

Setting Goals

“It was an environment where there was a lot of trust,” said Ms. Hanna, describing the club. “All those questions that were really frightening for me to ask before were suddenly a lot easier to ask when you’re with a group of your friends.”

Their biggest challenge was the day-to-day temptations when out shopping, but what kept them on the straight and narrow were the weekly money club meetings where everyone had to confess their spending. If anyone went overboard, the group supported and encouraged them to get back on track.

Helping each other set weekly goals was also key, Ms. Hanna said. “We didn’t want to deprive ourselves. We made it clear that you can spend money on the things you really love, but you had to make sure you had the money for the goals that you were working for too.”

A small goal might be to call the cell phone company to find out how to lower your bill. If your long-term dream is to buy a condominium, another goal could be to book an appointment with a mortgage broker to learn how much you might be preapproved for.

They also came up with the idea of a “rather factor.” “It’s the things, experiences, or people in your life that you’d rather spend your money on,” said Ms. Hanna. Each cookie keeps a “rather factor” card with their credit and debit cards. Every time they are tempted to spend, they look at the card.

Less than a year after forming the money club, they found themselves featured on the Debt Diet show after Ms. Dunsworth spontaneously sent Oprah their story. Money expert Jean Chatzky, a contributor to the show, encouraged them to write their book. It was published in September and is on bestseller lists in both Canada and the U.S.

Living ‘The Good Life’

The Smart Cookies launched a TV show in March on Canada’s W Network, designed to help people find creative ways to control their spending while still living “the good life.”

Something they teach is how to do a “hidden money audit.” For example, a family might count how many televisions they own and compare that with how many they really need.

“If you pare down and just focus on the things you actually need in your life, you’ll free up so much money that you can be putting towards your real dreams and goals,” Ms. Hanna said.

That might be more time with your family, another vacation, or increased peace and freedom to do things that make you happy.

They’ve also developed a website that offers articles, webinars, money management tools, and help for people wanting to find their nearest money club or create their own group.

But one of their most exciting projects, Ms. Hanna said, is helping to promote a Canadian educational program aimed at teaching financial life skills to young people. Called The City, the program is used by high school teachers in B.C.

“A good place to start for everybody” is to find a reliable financial advisor, she said. She also suggested getting recommendations from family members or friends who have accumulated wealth with the help of their financial advisor.

“When we started this group it was just the five of us doing it for each other, and now we’re so passionate and feel so lucky to be able to hopefully inspire other people to get control of finances as well,” said Ms. Hanna.

“We never ever thought that learning about money would be fun, but we’ve actually made it fun, because we challenged each other and you see the type of success you can have.”