Just last week, New York, my home and the state with the highest taxes, reinstituted a 4 percent sales tax on clothing and shoes. Meanwhile, the property tax in New York City has continued to rise, as reported by the Wall Street Journal. Further, this week a report from the New York State comptroller found that New York has experienced the first full-year decline in personal income in the last 70 years.

So, while taxes are rising in the Empire State, income is going down. This is scary.

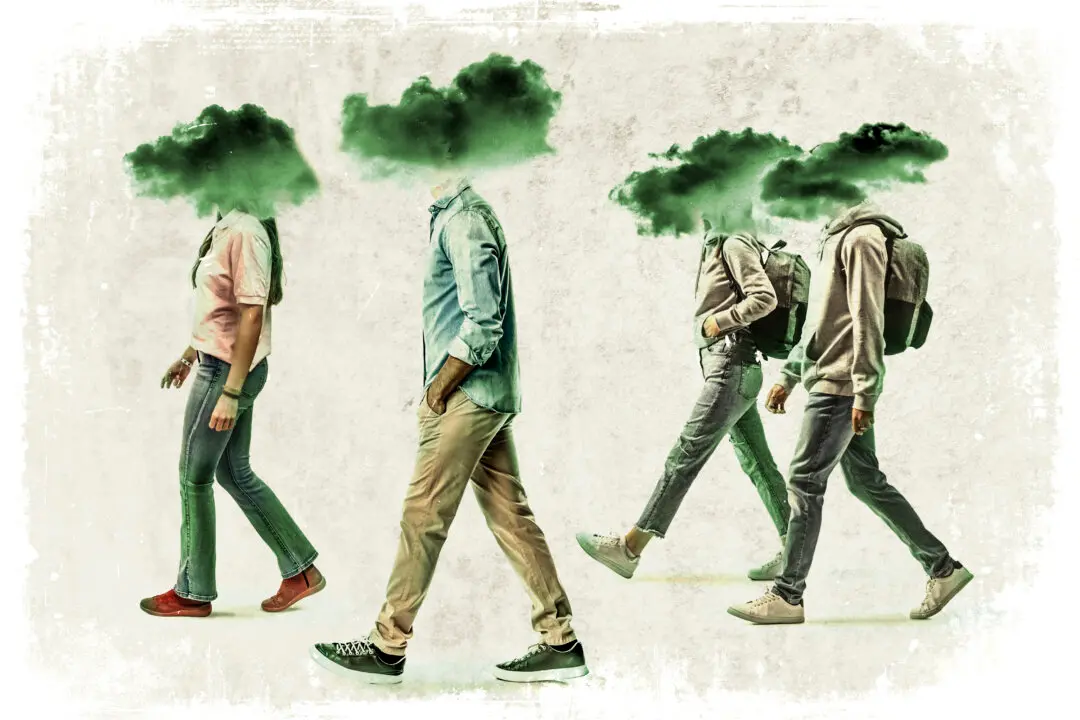

The root of all of this is what Senator and Finance Committee Chairman Max Baucus has identified as the 70,000 page tax code—including both the official 5,000 page code and reams of interpretations and explanations published by the Commerce Clearing House. It floats above the whole United States like a phantom. It taunts us at night with our own failures and ties us down with the increasingly heavy chains of bureaucracy.

The common logic is that the taxes are needed to pay off our state’s financial burden. I am willing to take that at face value and rest peacefully at night, but I am also acutely aware of effects the phantom is having on Americans.

Every new measure implemented by our government to sap more money from the people sends the wrong message to Americans. It teaches us to always be conniving to get more value out of the system and advance our personal goals.

The result? Businesses are often conniving to get more value from the system. The government wants to raise sales tax on clothes 4 percent, so the department store owner may pay his employees 4 percent less.

Regular American workers are also conniving. Their hard work and attention are their taxes that they take from the system. The government wants to raise sales tax on clothes 4 percent, so the department store employee who is having trouble with his finances may just leave four minutes earlier each night because he is sick of his low-paying job.

In other words, taxes beget small mindedness, which begets unnecessary frugality and apathy.

The only way to expel the tax phantom that haunts New York and the country is to shine a bright light on it. This means moving toward a tax system that is simple and transparent. Slicing the head off the phantom that is our tax code so it’s only 50,000 pages and then slicing it in half to 25,000 pages, and so on.

It’s by no means an easy task, but its something everyone should hope and strive for.

Every tax that is created and every cent taken from Americans’ pockets should have a face to it. Fine, raise the sales tax by 4 percent, but let Americans know that the money raised from that sales tax is being exclusively used for the maintenance and improvement of roads and transportation systems that are used to transport the piece of clothing from the factory to the store and from the store to my home.

In the same way, the trillions spent on the military could be directly paid by tariffs on exports and imports since our military is, in theory, ensuring the stability that makes the flow of goods into and out of our country possible.

Property taxes could go exclusively to paying for services like police, trash collection, and schools. Perhaps, welfare, public housing, and Medicare could be subsidized and paid for via tithing and publicly endorsed charities.

I can’t think of any reason that personal income should be nonvoluntarily taxed. That must be 20,000 pages off the phantom’s shoulders right there!

So, while taxes are rising in the Empire State, income is going down. This is scary.

The root of all of this is what Senator and Finance Committee Chairman Max Baucus has identified as the 70,000 page tax code—including both the official 5,000 page code and reams of interpretations and explanations published by the Commerce Clearing House. It floats above the whole United States like a phantom. It taunts us at night with our own failures and ties us down with the increasingly heavy chains of bureaucracy.

The common logic is that the taxes are needed to pay off our state’s financial burden. I am willing to take that at face value and rest peacefully at night, but I am also acutely aware of effects the phantom is having on Americans.

Every new measure implemented by our government to sap more money from the people sends the wrong message to Americans. It teaches us to always be conniving to get more value out of the system and advance our personal goals.

The result? Businesses are often conniving to get more value from the system. The government wants to raise sales tax on clothes 4 percent, so the department store owner may pay his employees 4 percent less.

Regular American workers are also conniving. Their hard work and attention are their taxes that they take from the system. The government wants to raise sales tax on clothes 4 percent, so the department store employee who is having trouble with his finances may just leave four minutes earlier each night because he is sick of his low-paying job.

In other words, taxes beget small mindedness, which begets unnecessary frugality and apathy.

The only way to expel the tax phantom that haunts New York and the country is to shine a bright light on it. This means moving toward a tax system that is simple and transparent. Slicing the head off the phantom that is our tax code so it’s only 50,000 pages and then slicing it in half to 25,000 pages, and so on.

It’s by no means an easy task, but its something everyone should hope and strive for.

Every tax that is created and every cent taken from Americans’ pockets should have a face to it. Fine, raise the sales tax by 4 percent, but let Americans know that the money raised from that sales tax is being exclusively used for the maintenance and improvement of roads and transportation systems that are used to transport the piece of clothing from the factory to the store and from the store to my home.

In the same way, the trillions spent on the military could be directly paid by tariffs on exports and imports since our military is, in theory, ensuring the stability that makes the flow of goods into and out of our country possible.

Property taxes could go exclusively to paying for services like police, trash collection, and schools. Perhaps, welfare, public housing, and Medicare could be subsidized and paid for via tithing and publicly endorsed charities.

I can’t think of any reason that personal income should be nonvoluntarily taxed. That must be 20,000 pages off the phantom’s shoulders right there!