Top members of the Republican House Ways and Means Committee met with Hungarian officials and subsequently signaled collective opposition against the Biden administration’s efforts to reach a deal on a global minimum tax of 15 percent on multinational companies.

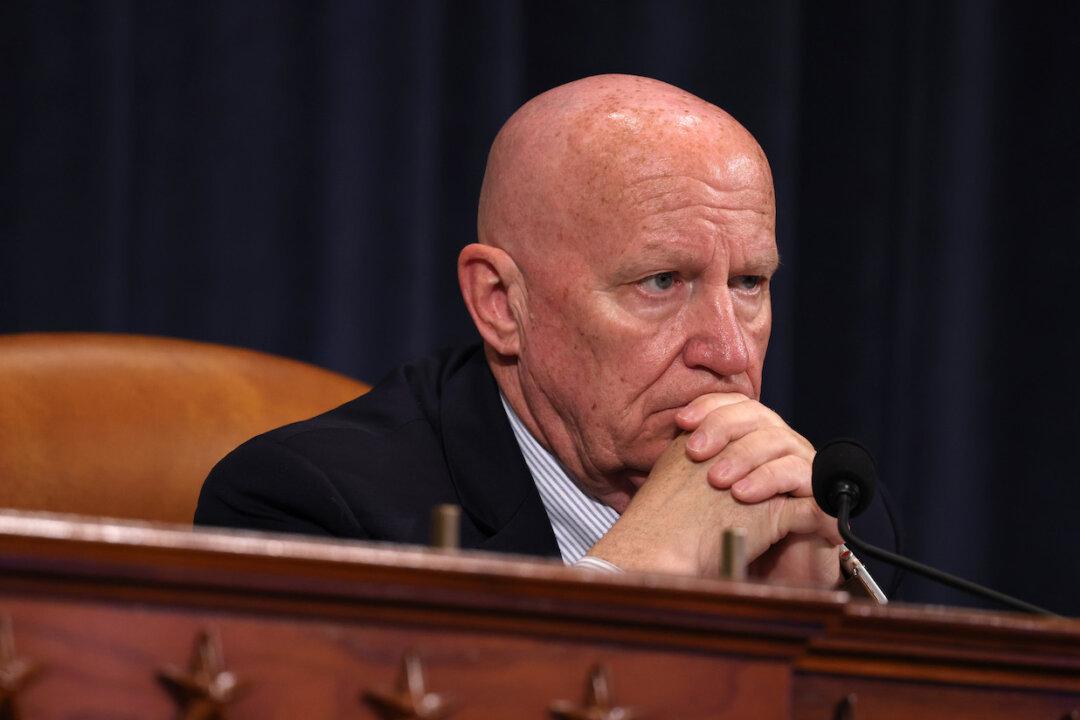

Republican Leader Rep. Kevin Brady (R-Texas), Trade Subcommittee Republican Leader Rep. Adrian Smith (R-Nebr.), and Select Revenue Measures Subcommittee Republican Leader Mike Kelly (R-Pa.) issued a statement denouncing the European Commission’s 15 percent corporate minimum tax directive that’s backed by the Biden administration.