The federal government is continuing its high-spending ways despite the end of its rationale for doing so, say the Parliamentary Budget Officer (PBO) and others concerned about long-term economic consequences.

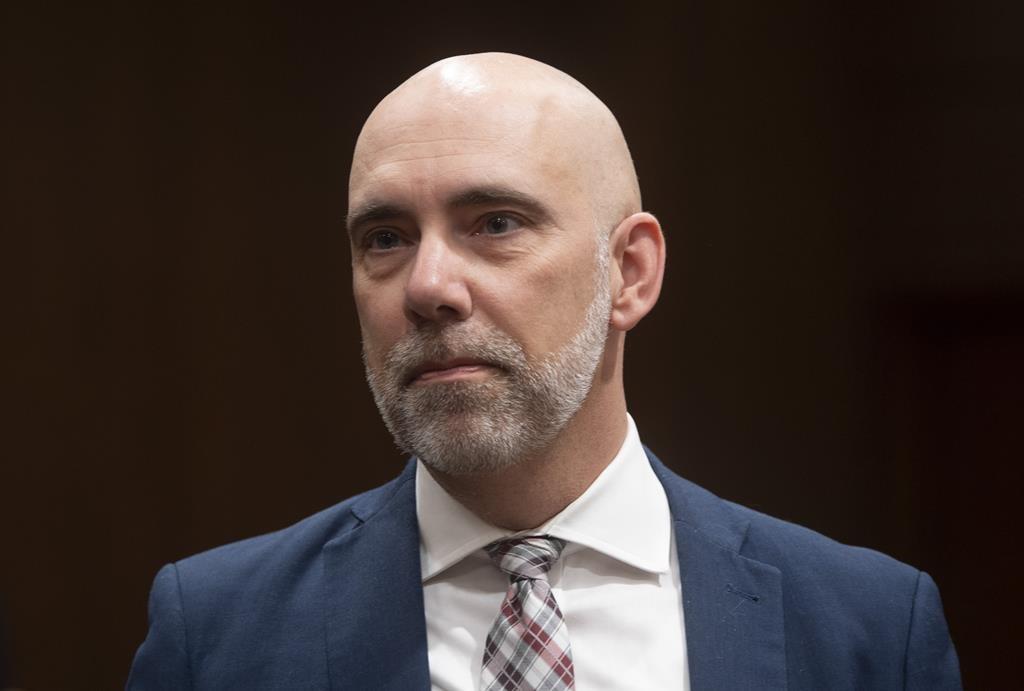

“Since the start of the pandemic, the Government has spent, or has planned to spend, $541.9 billion in new measures—almost one third of which [$176.6 billion] is not part of the COVID-19 response plan,” PBO Yves Giroux said announcing his mid-January report commenting on the feds’ 2021 economic and fiscal update (EFU) published Dec. 14, 2021.