Commentary

After over $100 billion in combined U.S. and EU Ukraine funding stalled over the last few weeks, the G7 countries are seriously considering taking $300 billion in frozen Russian funds for distribution to Ukraine. That would likely mean using Russia’s money to fund Ukraine’s military to defeat Russia.

That’s poetic justice.

“‘G7 members and other specially affected states could seize Russian sovereign assets as a countermeasure to induce Russia to end its aggression,’ said a US government discussion paper,” according to the Financial Times on Dec. 15.

“A US official said Washington was engaged in active conversations on the use of Russian sovereign assets and believed there was a short timeline to make a decision.”

The move could be as early as another G7 meeting in February. It’s about time.

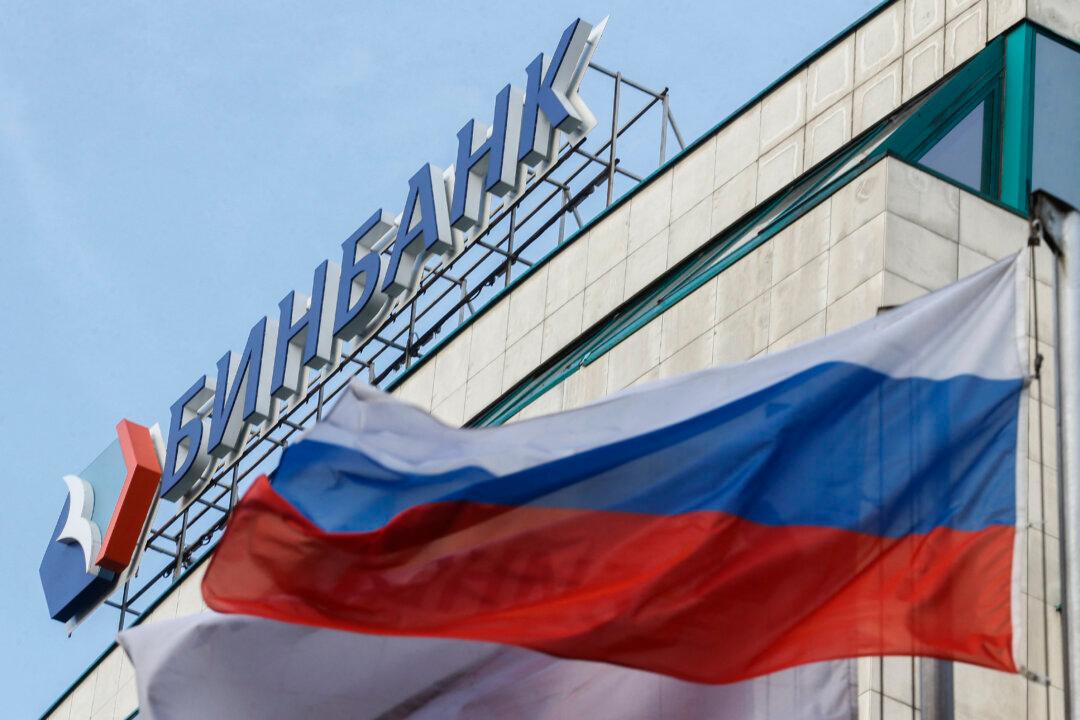

Better than U.S. taxpayers spending our hard-earned money on Ukraine would be to take the funds from the Russian government, not only to clean up the horrific mess it created but to defend what is left of Ukraine. It is unconscionable that Americans should pay for Ukraine’s defense when $300 billion of Russian blood money sits, frozen as the tundra, in Western banks.

Detractors of this financial jujitsu will claim that using the money will chill foreign investment and deposits in G7 country banks. But that damage has already been done. Afghanistan had $3.5 billion frozen when the Taliban took over, so at least since then, dictators and terrorists knew that democracies do not necessarily see their financial holdings as legitimate.

China is the mastodon in the room, as it has trillions of dollars worth of foreign currencies and other assets, like U.S. Treasury bonds, that could be frozen at any time as punishment, for example, for an invasion of Taiwan. Perhaps to avoid this fate, China already sold 40 percent of its Treasurys over the last decade.

Likewise, the threat and now actuality of shutting Russia out of the SWIFT (Society for Worldwide Interbank Financial Telecommunications) international banking network and other international utilization of the dollar has been used to justify efforts by rogue states to de-dollarize their trade, create alternative international money transmission networks, and consider new international currencies, for example, the BRICS (Brazil, Russia, India, China, and South Africa) currency that failed to be adopted in August.

Using Russian money against itself is just one of several new and admittedly controversial measures under consideration by the United States, Japan, Germany, France, Italy, the United Kingdom, and Canada, acting jointly as the G7. Other likely measures are tougher sanctions against Russian-origin blood diamonds in international markets and threats to impose costs against third parties such as China, Iran, and India, given their undermining of Russia sanctions through continued trade.

While Russia and China are ruled by apparently incorrigible dictators, Brazil, India, and South Africa should know better. Yet short-term economic gain too often leads them to cooperate with the wrong crowd and undermine G7 sanctions meant to help them in the long run by increasing global stability, including legitimate trade between democracies.

Many in India, for example, oppose sanctions on Russia’s diamond trade because small businesses in the country make a mint sorting and polishing them for re-export to the United States and China, among other places. Russia is the world’s biggest producer of rough diamonds at 30 percent, and India has 90 percent of the global cutting and polishing business.

But, for its own good, New Delhi needs to stop with its penny wisdom and pound foolishness. India only has access to the cheapest Russian exports, including oil, because the rest of the world is trying to do the right thing by honoring sanctions. Global instability is getting to the point now that India needs to be a team player. If India wants support from democracies against China taking its territory in the Himalayas, for example, India must support other democracies, including Ukraine, in their time of need.

This issue is greater than just “you scratch my back, and I scratch yours.” If India persists as a third-party spoiler, it should know that the G7 countries will impose costs. As the G7 noted in its statement on Dec. 6, “We will introduce import restrictions on non-industrial diamonds, mined, processed, or produced in Russia, by January 1, 2024, followed by further phased restrictions on the import of Russian diamonds processed in third countries [emphasis mine] targeting March 1, 2024.”

Over the next six months, G7 countries will establish “a robust traceability-based verification and certification mechanism for rough diamonds within the G7,” according to the statement.

Supporting any axis of evil country—including through trade with Russia, China, Iran, or North Korea—leads to longer-term national security costs that outweigh short-term profits to a few companies. The sooner all countries realize this, the better.