Commentary

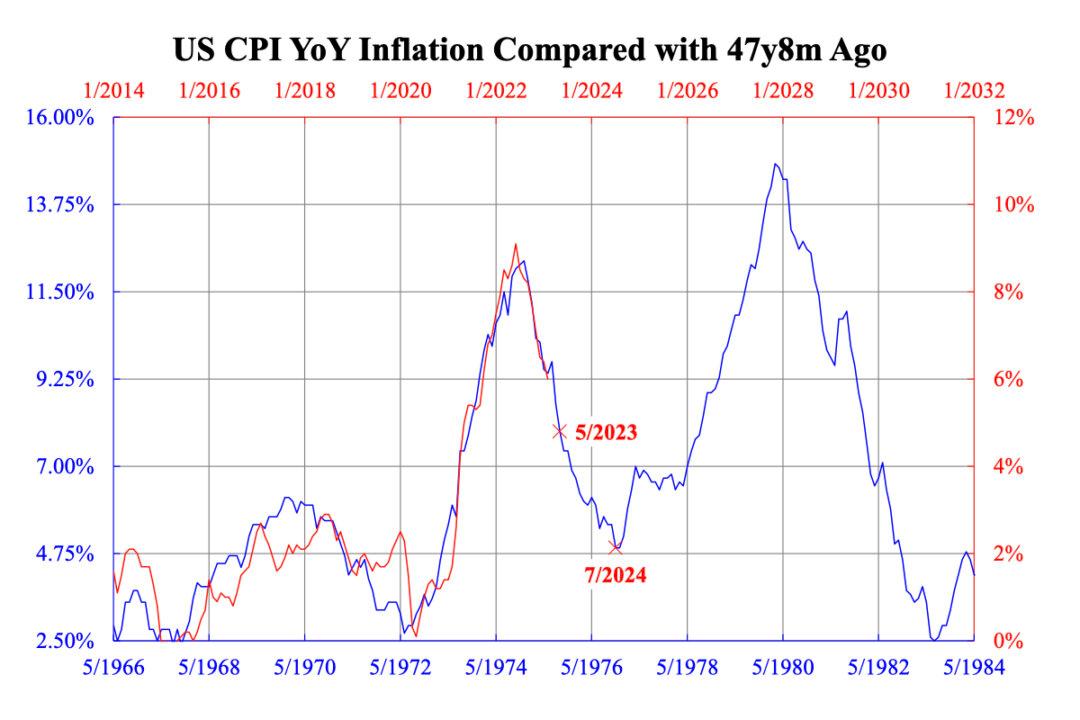

The rising cost of living, tightening credit, slowing consumer spending, along with declining real wages and retrenchment in the jobs market, are each conspiring and threatening to move the U.S. economy into recession later this year. Despite lower headline Consumer Price Index (CPI), inflation is still taking its toll on American families.