Commentary

February jobs printed at 275,000 new non-farm jobs this morning, according to the Bureau of Labor Statistics (BLS) Establishment Survey. December and January jobs creation revisions were down by 167,000 jobs. The headline number far surpassed the consensus estimate of 198,000 new jobs, but disappointed on a net basis of 108,000.

But the BLS’s Household Survey, which calculates the number of people taking jobs, and is viewed as eliminating workers taking more than one job, showed 184,000 fewer people working in February than in January. That included 188,000 people who lost jobs or completed temporary jobs.

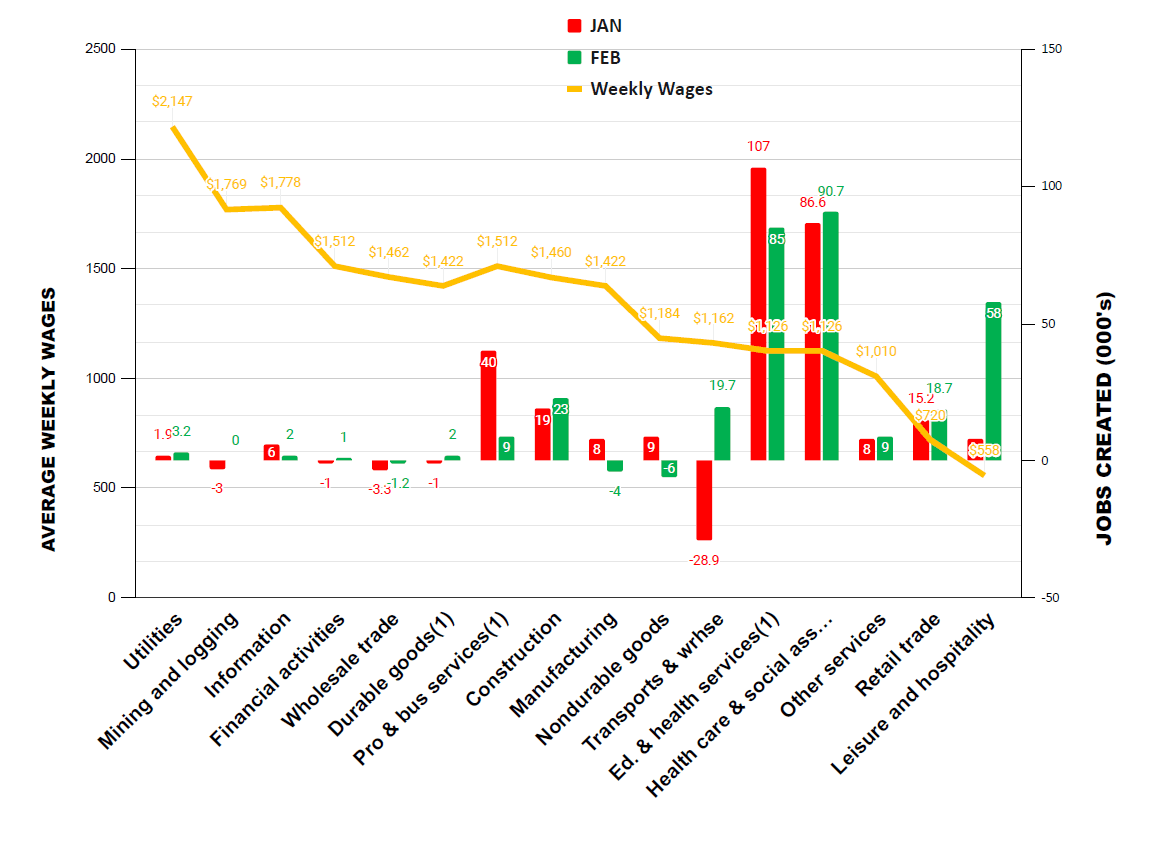

Let’s look at our exclusive schedule of February Jobs by Average Weekly Wages.

Source: "February Jobs Creation by Average Weekly Wages" / The Stuyvesant Square Consultancy