Commentary

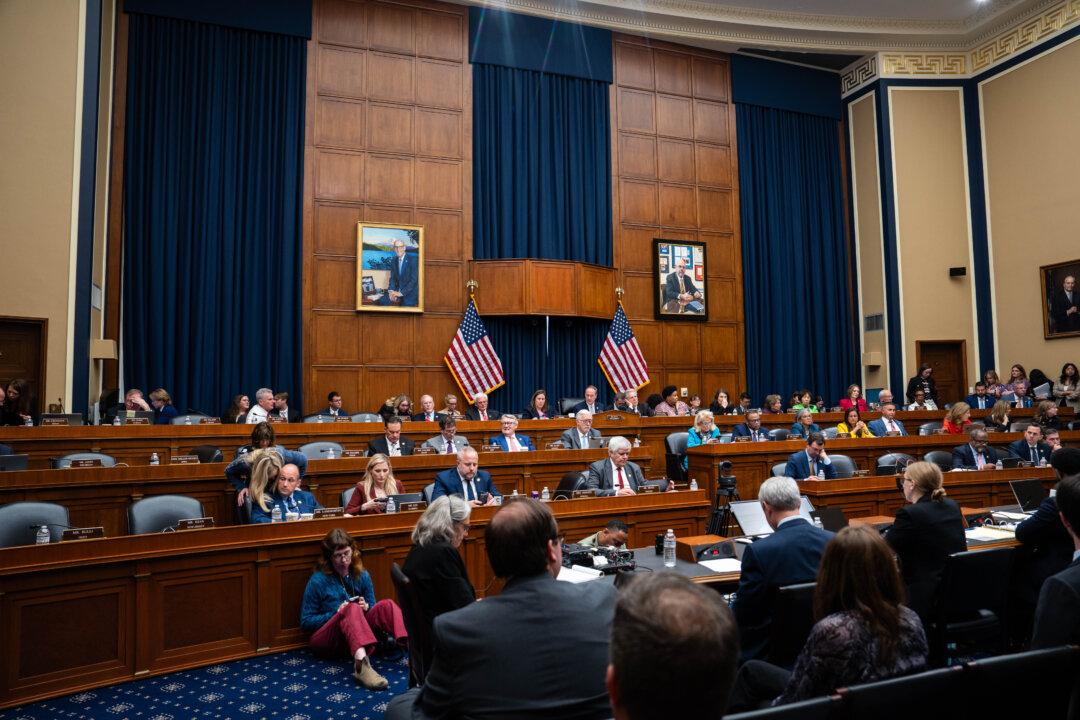

Republican lawmakers in the Senate continue to negotiate the budget reconciliation plan, which passed the House on May 22, with much of the focus on proposed tax cuts and Medicaid spending.

Republican lawmakers in the Senate continue to negotiate the budget reconciliation plan, which passed the House on May 22, with much of the focus on proposed tax cuts and Medicaid spending.