Commentary

Three Chinese tech companies on Feb. 21 lost $33 billion in value in U.S. stock trading. Alibaba Group, JD.com, and PDD Holdings are finding it harder to expand internationally, and so have turned to cutthroat competition with each other for domestic markets that will likely demolish their prices and profits.

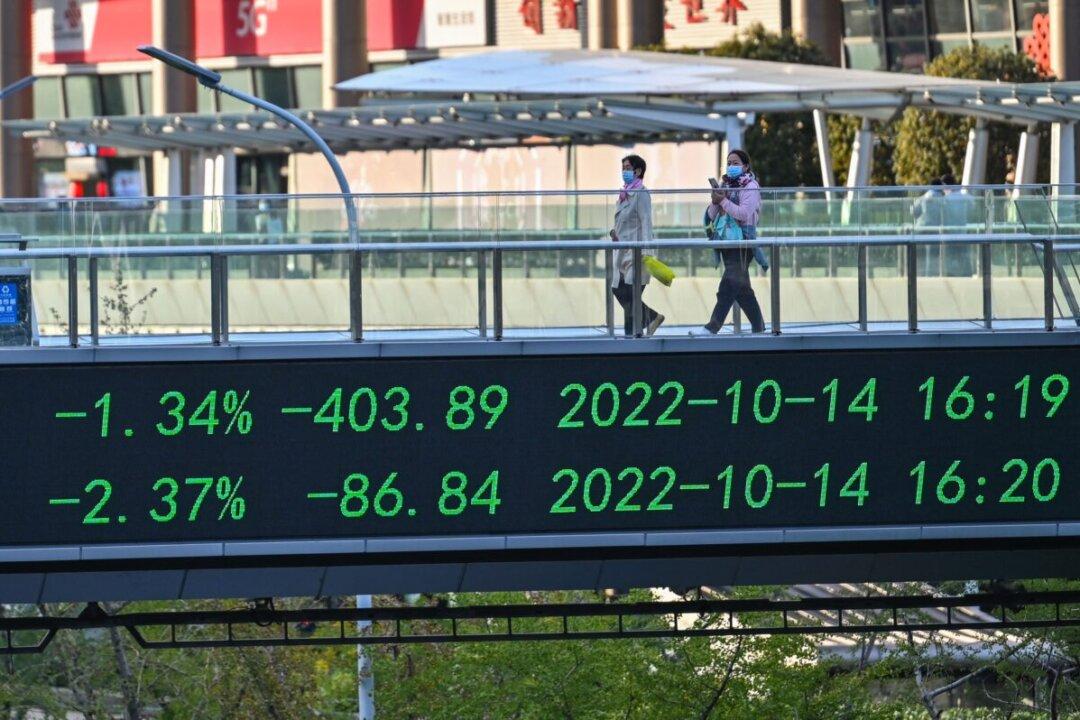

While within the past few months, Beijing signaled an end to its tech crackdown, canceled three-year COVID lockdowns, and claimed at Davos to be open for business again, the cheer for investors was wary, short lived, and followed by a hangover.

Foreign investors unwound from China after Beijing cracked down on the country’s most successful tech businesses and their leaders, most dramatically the disappearance of Jack Ma in 2020. The regime canceled his Ant Group’s initial public offering (IPO), expected to be the world’s most lucrative at more than $34 billion.

Didi, China’s top ride-hailing company, IPOed in the United States in 2021 for $4.4 billion. Days later, Beijing banned its app. The company was delisted from the New York Stock Exchange, lost about 70 percent of its value, and was investigated by the U.S. Securities and Exchange Commission (SEC).

Now, after all that bilking of international investors, Beijing is trying to court foreign money through IPOs again, but still without assured forms of shareholder ownership and robust corporate protections from taxes, overregulation, and arbitrary detention of company leadership.

In February, the Chinese Communist Party (CCP) apparently disappeared another billionaire tech titan named Bao Fan. There were no public charges, but his likely crime was a recent attempt to move some of his wealth to a family office in Singapore from China.