Commentary

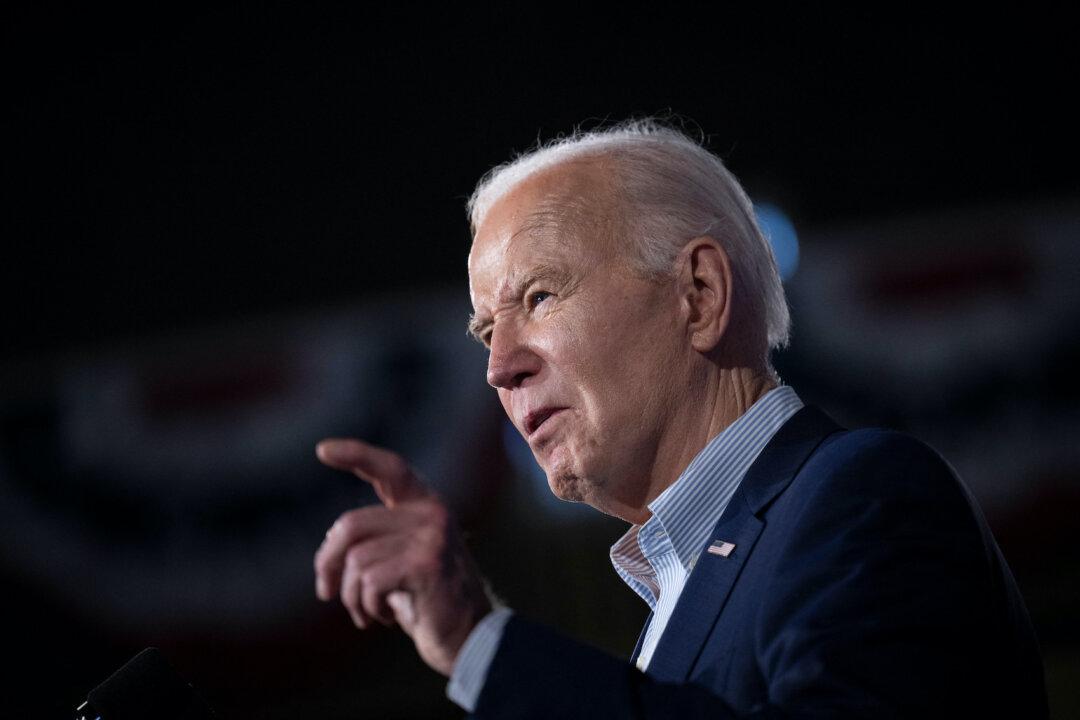

I am often asked if President Joe Biden is intentionally trying to dismantle the American economy with his terrible energy, climate change, crime, border, inflation, and debt policies. But I’ve always believed that these policies are driven by a badly mistaken ideology—not malice.