Commentary

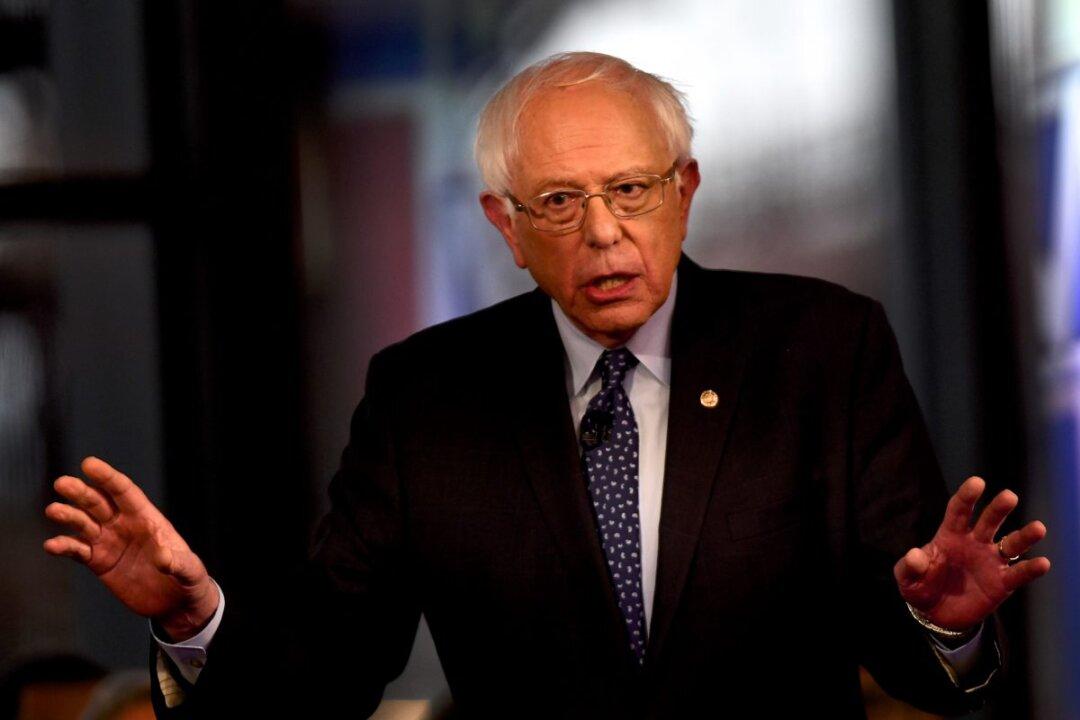

To quote former President Ronald Reagan, “Here he goes again.” Presidential candidate Sen. Bernie Sanders (I-Vt.) recently unveiled a new proposal to forgive all student loans.

To quote former President Ronald Reagan, “Here he goes again.” Presidential candidate Sen. Bernie Sanders (I-Vt.) recently unveiled a new proposal to forgive all student loans.