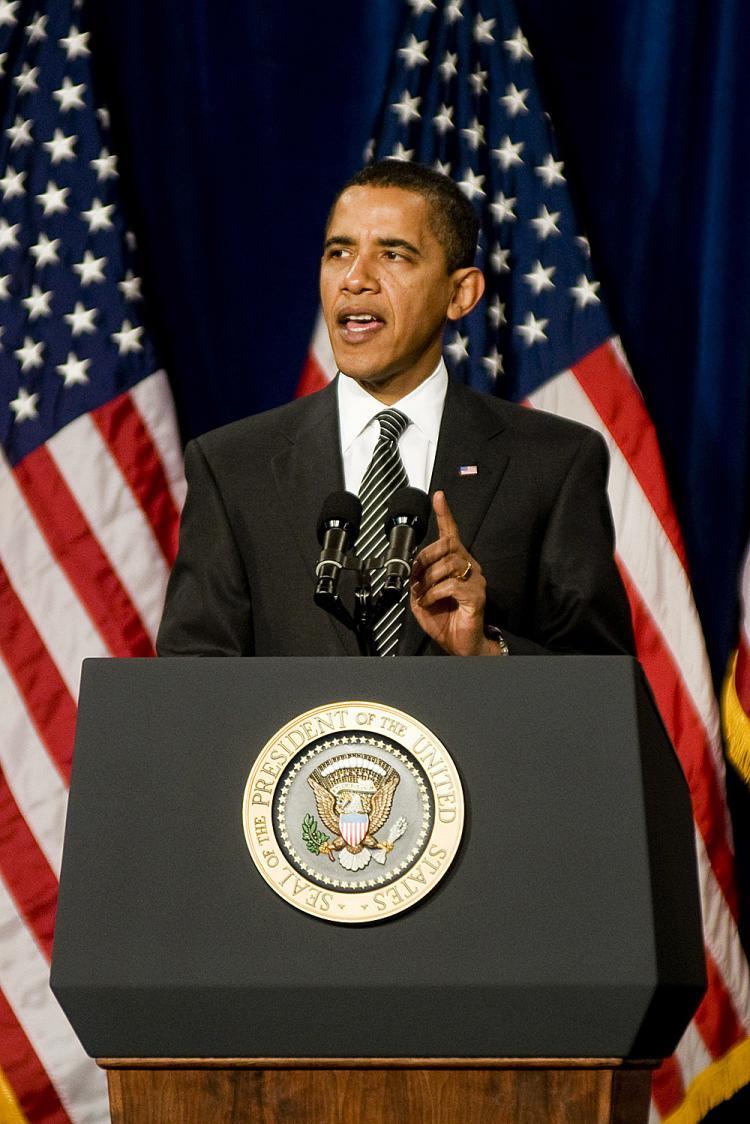

Announcing the plan from a school in Arizona, one of the hardest-hit states in the mortgage crisis, President Obama’s plan attempts to tackle the crisis from three fronts.

$75 billion will be spent to aid “responsible homeowners” in reducing monthly mortgage payments, and another $200 billion will be used to shore up Fannie Mae and Freddie Mac as well as help borrowers refinance their mortgages.

The announcement barely made ripples on Wall Street. Stocks ended flat after the press conference. Despite its high price tag, many analysts and experts are also questioning the feasibility and efficacy of the plan.

In his defense, the President had little choice. He had to do something—anything—about falling real estate prices and rising foreclosure. After four federal measures aimed at stabilizing the housing market, the market continues to deteriorate daily and 2.3 million Americans faced foreclosure proceedings last year.

“The plan I’m announcing focuses on rescuing families who have played by the rules and acted responsibly,” Obama said in a televised address.

A large issue that looms over the bill, and one that most analysts have doubts about, is who exactly qualifies as a “responsible” homeowner.

Lawmakers suggest that people who were deceived by unscrupulous lenders and those who live in areas where real estate prices dropped the most fit the bill. Subprime borrowers who knowingly took out loans that they cannot afford and real estate speculators are disqualified.

One limitation to the plan is the U.S. unemployment situation. Many people who currently face foreclosure lost their jobs or seen their work hours severely cut, and unless their monthly payments are drastically reduced, many still cannot afford the mortgage payments.

With many companies continuing to lay off workers—rubber manufacturer Goodyear laid off 5,000 this week—experts don’t see the unemployment rate dipping until the end of 2009, at the earliest.

A major portion of President Obama’s plan hinges on banks working with the federal government to refinance mortgages, especially for homeowners who are “under water,” meaning the current value of their homes is lower than the original borrowed amount.

But without a stable source of income, no bank will agree to refinance a borrower’s mortgage.

“Among the concerns we have is that it seems to offer little help to borrowers whose loan exceeds their property value by more than five percent,” said Mortgage Bankers Association (MBA) President John Courson in a statement. “This will limit the plan’s success in some of the hardest hit areas in California, Florida, Nevada and Arizona, as well as some areas on the East Coast.”

Another uncertainty is whether banks would comply. The plan stops short of forcing banks to buy into the program—it offers incentives and encourages banks to reduce mortgage payments by having the federal government take on a portion of the cost.

In the end, analysts agree that the measure will keep some Americans in their homes—for now—but will do little to stabilize the housing market and bring about a real economic recovery. The plan doesn’t incentivize consumers to purchase the current glut of unsold homes or reverse the course of plunging real estate prices.

Some market fundamentalists argue that the only way to stabilize the market is to allow foreclosures—the free market’s medicine for an overheated housing market—to take place.

“The mad attempt to avoid any and all foreclosures is counter-productive,” Barry Ritholtz, director of equity research at forecaster FuisonIQ, said in an interview with Globe and Mail. “The foreclosure process is how an overpriced market returns to normalcy.”

Under that assumption, President Obama’s plan merely delays economic recovery.