NY Congressmen Urge IRS to Help Ponzi Victims

In the effort to help thousands of taxpayers across the United States recover assets lost in fraudulent...

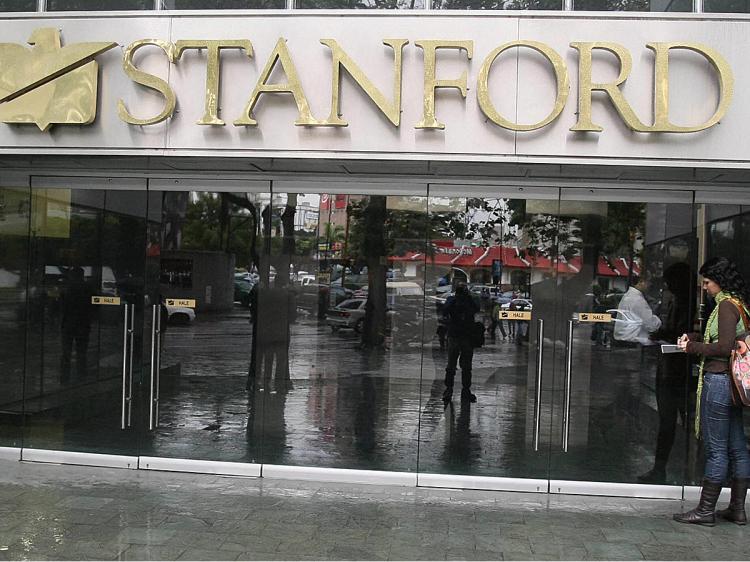

The main entrance to the headquarters of the Standford Bank in Caracas, seized by the Venezuelan government after owner Allen Stanford was accused of defrauding investors around the world. Pedro Rey/AFP/Getty Images

|Updated: