In the last couple of years, Americans have felt the pressure of the recent global economic recession, tightening their belts to limit expenses and fund the necessities, while pursuing happiness and quality of life. But as citizens, small businesses, and local communities seek ways to manage spending and address leaner revenues, a national debt crisis is lurking in the wings—$13 trillion dollars of national debt.

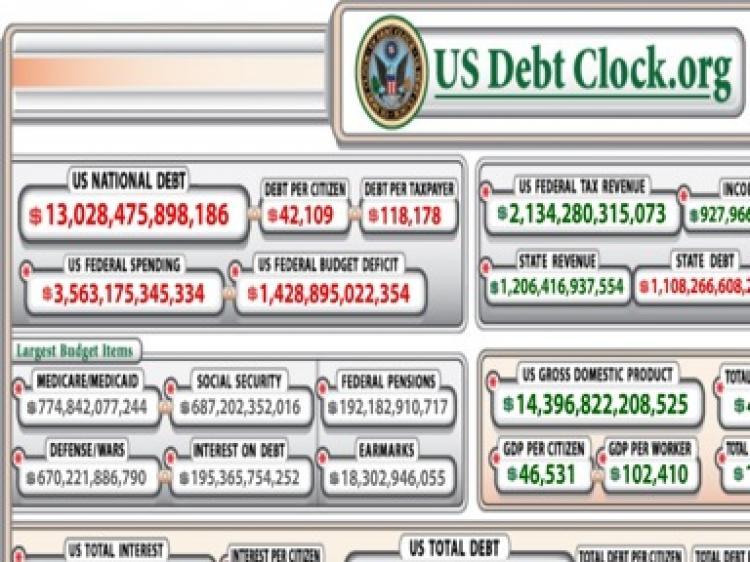

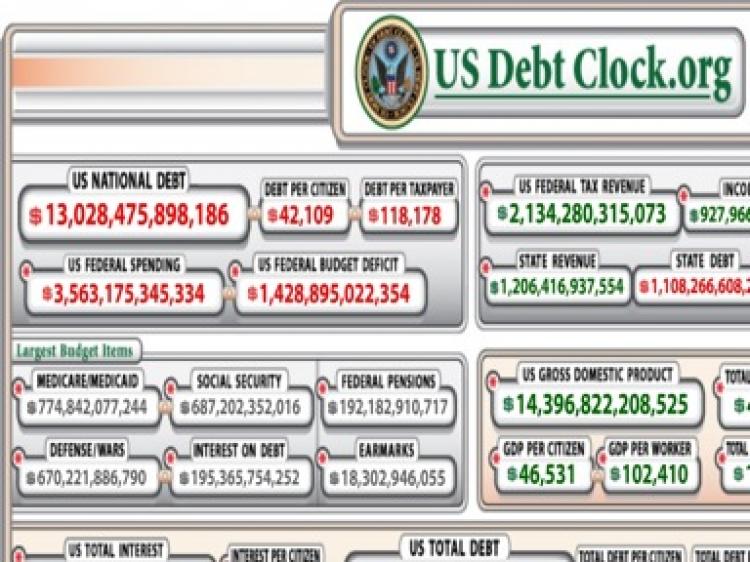

And it doesn’t stop there. At the rate-of-increase displayed at monitoring sites like the independent website USDebtClock.org, this gross federal debt and its interest are rising at a rate of $1 million every 30 seconds.

This rate equates to a debt increase of $720 million a day.

And this figure may be conservative, as the scope of the data involved may limit the ability to provide accurate projections. Some sources claim this daily increase to be as high as $3 billion to 4 billion a day.

Presenting a dynamic display of real-time statistics covering everything from the national debt to the creation of money, USDebtClock.org presents an alarming picture of America’s rapid slide into ever-increasing debt, and the burden faced by present and future generations.

The $13.03 trillion equates to $42,000 of debt for every American—young and old—and nearly $120,000 per taxpayer (out of a population of 309.4 million, 110 million are taxpayers).

Spread evenly, each citizen is accumulating $2.32 of this debt every day. But for taxpayers, that amount nearly triples to $6.53 a day, or $2,383 a year.

The majority of the government’s federal budget is spent on entitlement programs like Medicare/Medicaid ($775 billion) and social security ($687 billion), with defense spending a close third ($670 billion).

The independent USDebtClock.org states its mission as “to inform the American people about this country’s dire financial situation,” drawing from various data sources—like the Congressional Budget Office and U.S. census—to compile its data.

The gross federal debt, or “national debt,” is the sum of all federal liabilities, to include federal debt held by outside investors (securities issued by the Treasury Department), and debt held by the federal government itself.

On Jan. 1, 2001, the public debt from the founding of the country to date was $5.66 trillion dollars; this debt has more than doubled in the just last 10 years.

President Obama, in a letter to Congress May 24, proposed the “Reduce Unnecessary Spending Act,” which he stated would be an “important step in restoring fiscal discipline and making sure that Washington spends taxpayer dollars responsibly.”

The proposal would increase executive power to allow the president to examine provisions of legislation for dubious spending for removal. Empowered with this line-item procedure, the president would then turn to Congress to accept or reject his list—without the mechanism of filibustering—by a simple majority up-or-down vote.

The proposal, according to observers like conservative columnist George Will, may face constitutional challenges if passed, as it skirts the Constitution’s defined separation of powers into three distinct branches.

In his Sunday column Mr. Will referred to a 1996 statute that gave then-President Bill Clinton line-item veto powers over legislation from Congress; a power later overturned by the U.S. Supreme Court.

“That law’s constitutional infirmity was that it empowered the president to cancel provisions of legislation,” Will said in his column. “This violated the separation of powers by making the president’s activity indistinguishable from making laws rather than executing them.”

The U.S. Constitution states that “All legislative Powers herein granted shall be vested in a Congress of the United States, which shall consist of a Senate and House of Representatives.”

The document further defines the role of the chief executive as accepting through signature the legislation created by Congress, or rejecting it with objections and sending it back to Congress for reconsideration.

And it doesn’t stop there. At the rate-of-increase displayed at monitoring sites like the independent website USDebtClock.org, this gross federal debt and its interest are rising at a rate of $1 million every 30 seconds.

This rate equates to a debt increase of $720 million a day.

And this figure may be conservative, as the scope of the data involved may limit the ability to provide accurate projections. Some sources claim this daily increase to be as high as $3 billion to 4 billion a day.

Presenting a dynamic display of real-time statistics covering everything from the national debt to the creation of money, USDebtClock.org presents an alarming picture of America’s rapid slide into ever-increasing debt, and the burden faced by present and future generations.

The $13.03 trillion equates to $42,000 of debt for every American—young and old—and nearly $120,000 per taxpayer (out of a population of 309.4 million, 110 million are taxpayers).

Spread evenly, each citizen is accumulating $2.32 of this debt every day. But for taxpayers, that amount nearly triples to $6.53 a day, or $2,383 a year.

The majority of the government’s federal budget is spent on entitlement programs like Medicare/Medicaid ($775 billion) and social security ($687 billion), with defense spending a close third ($670 billion).

The independent USDebtClock.org states its mission as “to inform the American people about this country’s dire financial situation,” drawing from various data sources—like the Congressional Budget Office and U.S. census—to compile its data.

The gross federal debt, or “national debt,” is the sum of all federal liabilities, to include federal debt held by outside investors (securities issued by the Treasury Department), and debt held by the federal government itself.

On Jan. 1, 2001, the public debt from the founding of the country to date was $5.66 trillion dollars; this debt has more than doubled in the just last 10 years.

White House Proposal

President Obama, in a letter to Congress May 24, proposed the “Reduce Unnecessary Spending Act,” which he stated would be an “important step in restoring fiscal discipline and making sure that Washington spends taxpayer dollars responsibly.”

The proposal would increase executive power to allow the president to examine provisions of legislation for dubious spending for removal. Empowered with this line-item procedure, the president would then turn to Congress to accept or reject his list—without the mechanism of filibustering—by a simple majority up-or-down vote.

The proposal, according to observers like conservative columnist George Will, may face constitutional challenges if passed, as it skirts the Constitution’s defined separation of powers into three distinct branches.

In his Sunday column Mr. Will referred to a 1996 statute that gave then-President Bill Clinton line-item veto powers over legislation from Congress; a power later overturned by the U.S. Supreme Court.

“That law’s constitutional infirmity was that it empowered the president to cancel provisions of legislation,” Will said in his column. “This violated the separation of powers by making the president’s activity indistinguishable from making laws rather than executing them.”

The U.S. Constitution states that “All legislative Powers herein granted shall be vested in a Congress of the United States, which shall consist of a Senate and House of Representatives.”

The document further defines the role of the chief executive as accepting through signature the legislation created by Congress, or rejecting it with objections and sending it back to Congress for reconsideration.