Commentary

The financial markets are fragile right now. And there’s no better illustration of this than the multiple layers of issues plaguing the U.S. mortgage market.

To U.S. consumers, the mortgage interest rate is probably the most direct translation of the Federal Reserve’s interest-rate moves. More than 50 million Americans have a mortgage, and a significant portion of Americans’ net worth is tied to their primary homes.

Let’s quickly walk through what happens when someone takes out a mortgage. A bank or mortgage lender (such as Rocket Mortgage) originates the mortgage and earns a fee from the borrower. The lender sells the mortgage within 30 days of closing—which frees up the cash to make the next loan—to an entity that pools bundles of hundreds of mortgages and issues a mortgage-backed security (MBS). Depending on how the mortgage was underwritten, many MBSs are backed by federal government agencies such as Fannie Mae, Ginnie Mae, and Freddie Mac. Investors, including investment funds, pension funds, insurance companies, and foreign institutions, buy these MBS bonds. As the homeowner makes monthly principal and interest payments, a mortgage servicer ensures that the right parties (e.g., investors) receive their appropriate payments timely.

That’s the basic premise. Today, this intricate financial system handling mortgages is seizing up. And in this volatile market environment, where Wall Street analysts are watching for something to go wrong that could trigger a cascade of financial woes, the mortgage market is a potential falling domino.

There are two developments causing this.

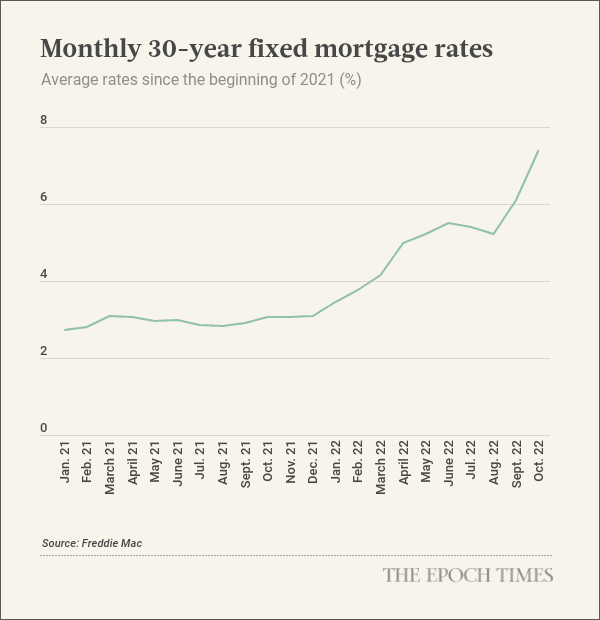

One is the speed of the Federal Reserve’s interest-rate hikes. Mortgage rates have risen and fallen throughout history, but very rarely have mortgage-rate changes moved with the velocity seen over the last few months.

This has brought mortgage issuances to a screeching halt. Today, with rates around 7 percent, there are few people getting new mortgage or refinancing their existing mortgages. We should note that refinancing, which is replacing an existing mortgage with a new, often lower interest rate one, has provided banks and lenders significant volume over the past several years when interest rates were low. Who wants to replace a 4 percent mortgage with a 6.5 percent one? Nobody.

The trend has hit mortgage companies particularly hard. Thousands have been laid off. A few mortgage lenders either declared bankruptcy (e.g., First Guaranty) or shut down (e.g., Sprout). The speed at which rates moves has caused significant losses for lenders who haven’t yet sold their recently originated loans—after all, no entity will want to buy a three-week old mortgage at par if prevailing rates have suddenly gone up 200 basis points.

An increase in interest rates has also significantly increased the effective duration of MBS bonds. When borrowers are refinancing and paying off old loans, mortgage bonds are also paying off quicker. Today, borrowers are likely to keep their mortgages for longer, effectively lengthening the time horizon these bonds will be outstanding. The longer duration makes the price of these bonds more sensitive to rate movements.

The other development is that the biggest buyers of mortgages are suddenly no longer buying. Liquidity for mortgages and MBS securities are lower than they have been in a long time. The Federal Reserve, which bought more than $1 trillion of MBS securities during the last two years, is in the midst of its quantitative tightening policy and is no longer buying. Investment banks, another source of liquidity for the mortgage market, have also ceased purchasing mortgage loans.

To sum things up, the mortgage market is suddenly beset by significant price decline caused by sudden interest-rate moves and a massive liquidity drain caused by buyers no longer buying.

Mortgage real estate investment trusts (REITs) also are suffering. Angel Oak Mortgage REIT, for example, is down 26.9 percent from Jan. 1 to Sept. 30. Annaly Capital Management, the biggest mortgage REIT, is down 45.1 percent during the same period. AGNC Investment Corp. had declined 44.0 percent.

Struggling mortgage companies are retrenching, laying off staff, and just hoping to survive until the market turns. LoanDepot reported a $223 million loss in the second quarter, closed its wholesale business, and cut nearly 5,000 jobs. Online mortgage lender Better.com is in the midst of its fourth wave of layoffs since the end of 2021. Even big banks such as JPMorgan Chase, Wells Fargo, and Citigroup have announced massive staffing cuts in their mortgage departments.

A panic or an error in this environment can set off a domino effect of financial destruction. Conversely, an astute and contrarian investor can see significant opportunities in this market.