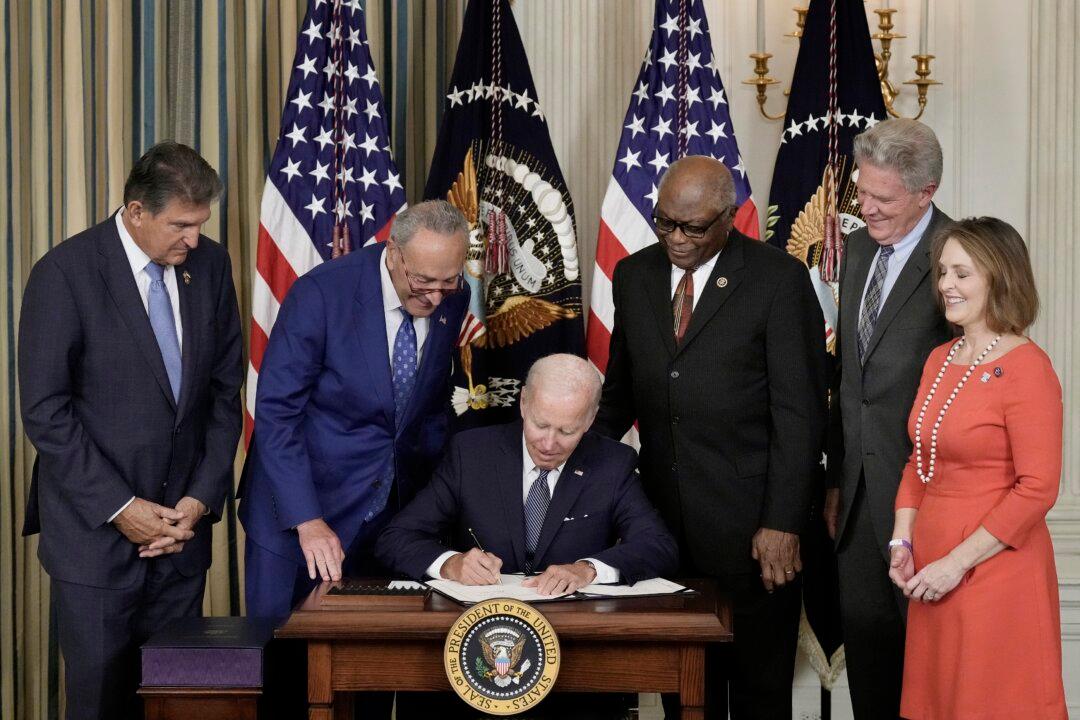

When President Joe Biden signed the Inflation Reduction Act into law on Aug. 16, his signature opened the door to reinstating the largest oil and gas lease sale in U.S. history, which had been blocked by a court because of climate impact concerns.

The Inflation Reduction Act includes provisions that direct spending, tax credits, and loans to bolster technologies such as solar panels and equipment to cut pollution at coal- and gas-powered power plants.