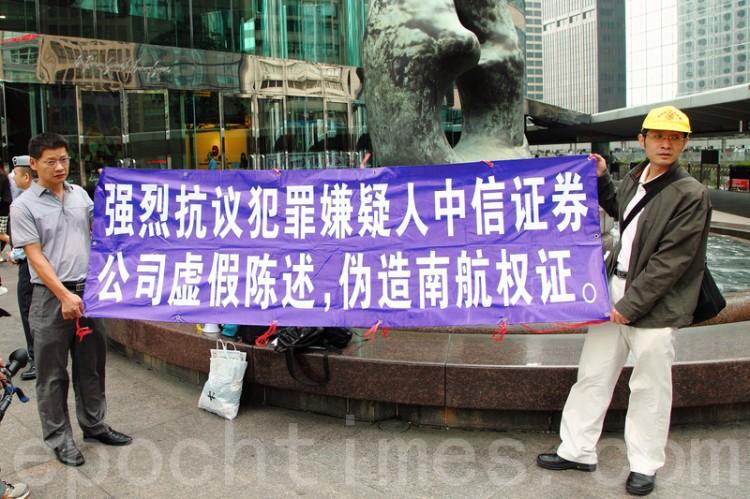

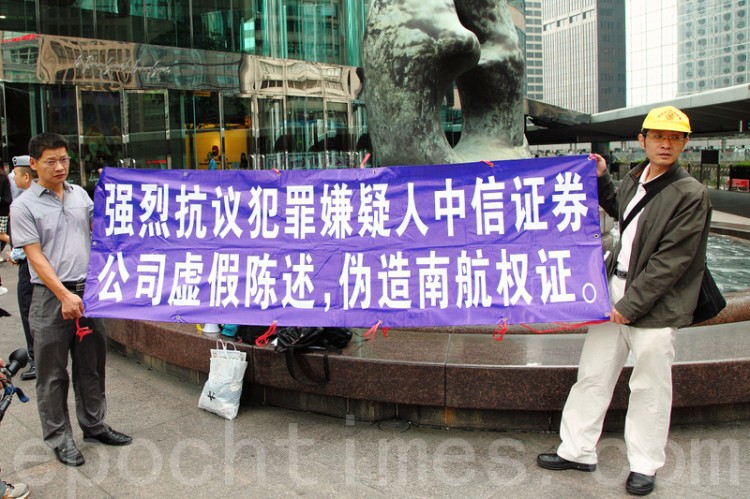

Mainland Chinese Investors in Hong Kong Protest Securities Fraud

Accusing a consortium of 26 brokerages of stealing their money via forged securities, Chinese from the mainland protested on Oct. 6 a proposed public offering in Hong Kong.

Mainland Chinese investors protested CITIC Securities for fraud on its initial public offering of shares in Hong Kong on Oct.6. The protestors said their losses totaled 100 billion yuan, calling on Hong King people to beware. Pan Zaishu/ Epoch Times

|Updated: