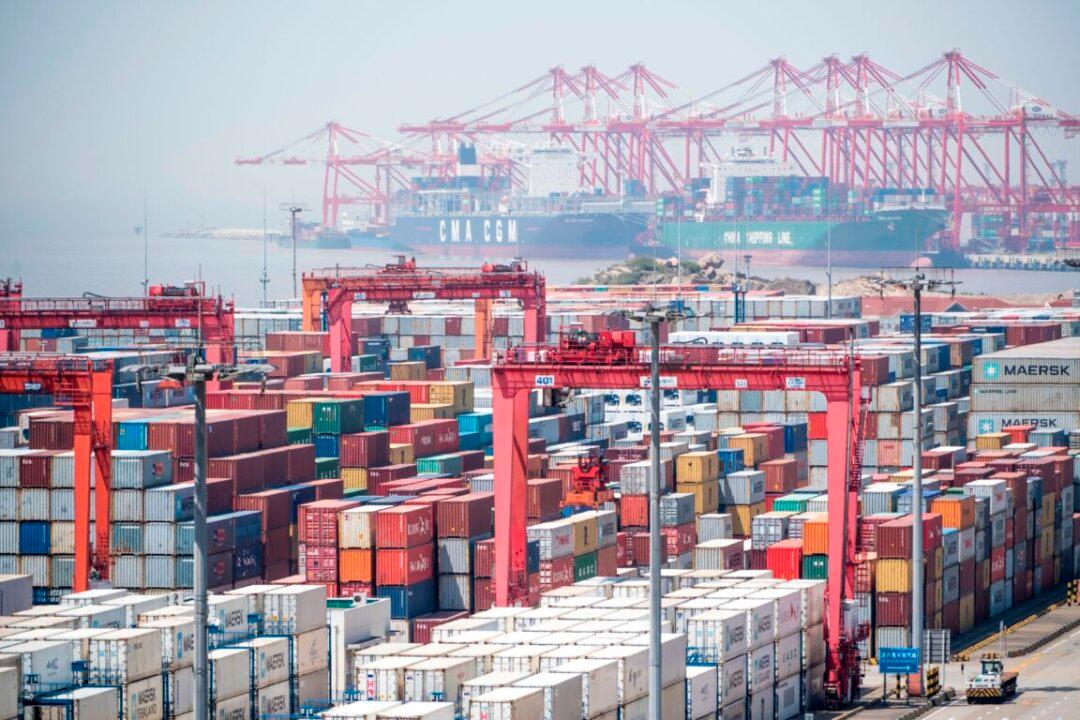

A prolonged citywide lockdown caused congestion in the Port of Shanghai and affected the global supply chain due to the megacity’s influential position in foreign trade and transportation.

Zhang Jinglun, a U.S. financial expert, told The Epoch Times that the Shanghai lockdown, part of China’s intensifying anti-virus measures, is bound to cause disruptions in production and logistics there, and many shipments will be delayed, thus exacerbating the global supply chain and inflationary pressures, especially in the United States, citing, Shanghai’s crucial role in the global manufacturing industry.