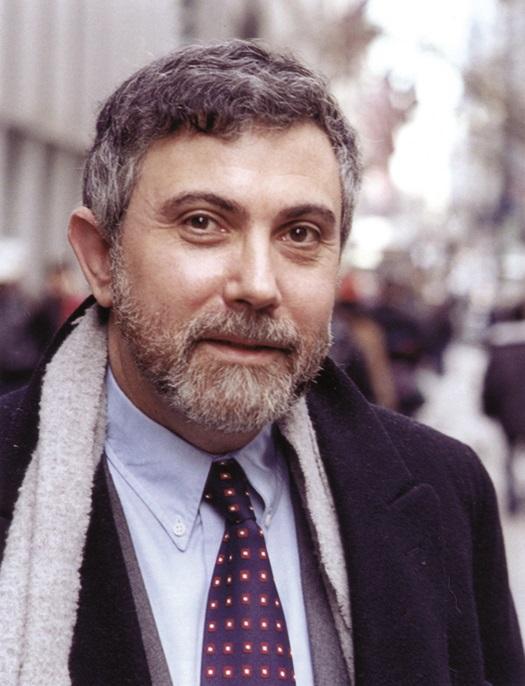

NEW YORK—Paul Krugman is perhaps the most well-known voice of neo-Keynesian economic theory. In a discussion hosted by 92Y in New York on Jan 27., he lived up to his reputation and called for the government and the Federal Reserve to spend and print more money.

“What’s key to the economy is a couple of public works projects that create jobs,” said Krugman. The Princeton professor and New York Times columnist follows the Keynesian school of economics which propagates government spending when private demand is faltering.

After the financial crisis of 2008, consumers and businesses have largely shut their wallets and paid down debt, leading to a slump in spending. Unemployment and anemic wage growth have further reduced consumer spending power. Since the U.S. economy is 70 percent consumer-driven, this is a major reason for the sub-par recovery.