Japan’s Ministry of Finance announced that the national debt rose to a record 1.025 quadrillion Yen (or $10.1 trillion) at the end of March. Japan’s debt reached the quadrillion Yen mark in late 2013. Japan’s public sector debt reached 243% of its GDP in 2013 (compared with 105% for the US, 133% for Italy and 174% for Greece). Due in part to high pension costs, Japan’s budget deficit is one of the largest of any other major economy. In 2013, Japan’s fiscal deficits totaled 8.4% of its GDP, compared with 3.0% for the EU and 7.3% for the US. These startling numbers have led some analysts question whether Japan will someday default on its enormous debt like Greece had.

With a public debt two times the nation’s economy (478 trillion Yen), it is no wonder why the last three Prime Ministers have supported a sales tax hike. Former Prime Minister Yoshihiko Noda staked his entire political career on increasing the tax, fighting off opponents in his own party. Noda was able to get the lower house to approve the tax increase to 10% in June, 2012. He left office about 6 months later.

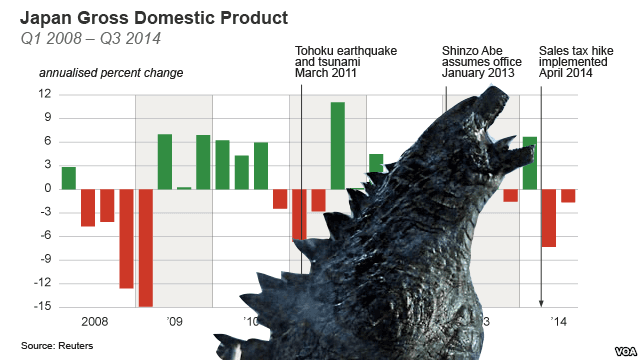

The Abe administration picked up the baton and supported the tax hike in the hopes that it will lower the budget deficit to about 6.4% of GDP. The Bank of Japan (BOJ) is also doings its by implementing massive purchases of government debt, a measure that has reduced the supply of government debt in the market, lowered long-term interest rates, and nearly erased interest expenses for the government. The BOJ’s strategy to boost inflation is also expected to ease the government’s debt burden by reducing the value of outstanding liabilities.

One unique aspect of Japan’s public debt is who owns it: nearly 92% of bonds are held by Japanese citizens. This characteristic sets Japan apart from Greece. Greece defaulted on their enormous public debt of which 70% of it was held by foreign investors.

Japan has a massive pool of domestic deposits to draw upon to fund its debt issuance. Japanese household assets total about 1,400 trillion Yen ($15 trillion), which is roughly three times bigger than the country’s economic output. This chunk of savings can then be funneled into Japanese government bonds. Because of this, some analysts think that Japan isn’t much worse off than Belgium and Italy were in the 1990s, and both nations avoided a sovereign debt crisis.

Plus Greece owed Euros, but did not have the ability to print Euros. Japan, on the other hand, can use the BOJ to print Yen, ultimately providing the government as much Yen as it needs. Japan is almost incapable of default because it can always print money to repay its debts.

Although Japan’s ballooning debt poses some level of risk and should be reduced, it poses no real threat at the moment. Japan isn’t facing a Greece-like debt crisis, and the Yen will remains to be a key international currency.

Originally published on Izakaya Politics.