Investment Environment Threatens Businesses in China

Officials and regulators sometimes profit more than business owners in China.

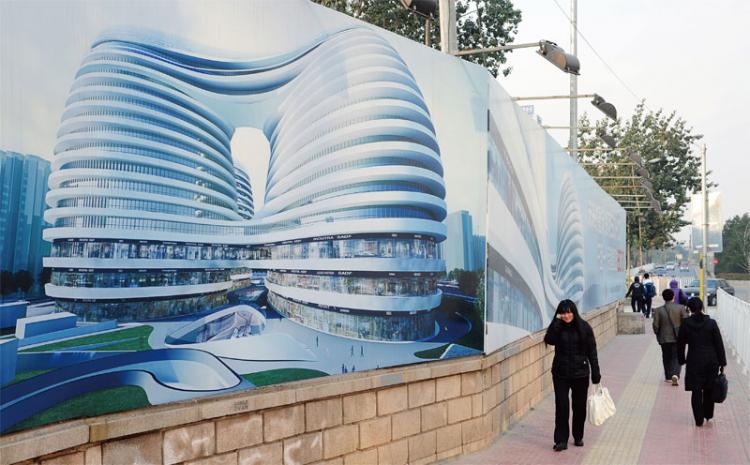

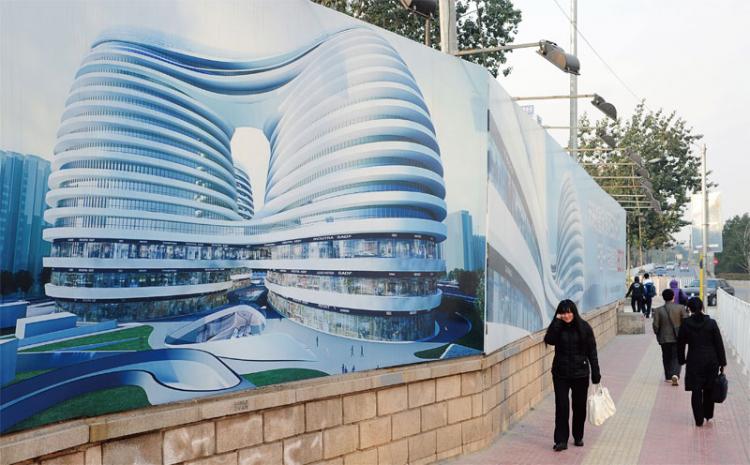

Chinese economy has hidden pitfalls. The absence of a stable environment for businesses to thrive has driven Chinese business people and foreign investors away. AFP/Getty Images

|Updated: