Intuit develops tax preparation software TurboTax, personal finance application Quicken, and accounting software QuickBooks. Mint.com was launched by entrepreneur Aaron Patzer in 2007, and competes with Intuit’s Quicken Online personal finance service.

Mint.com has become a Web sensation during the past year and is frequented by more than 1 million users seeking a free way to track their spending.

“With this transaction, Intuit will gain another fast-growing consumer brand and a highly successful Software as a Service (SaaS) offering that helps people save and make money,” said Brad Smith, Intuit CEO, in a statement. “This move will enhance Intuit’s position as a leading provider of consumer SaaS offerings that connect customers across desktop, online and mobile.”

Intuit has been attempting to rely less on its tax prep software, the best-seller TurboTax, and expand its online offerings. Most of its financial services are geared toward small businesses and nonprofits.

Acquiring Mint.com eliminates a potential competitor and also gives the company a strong consumer brand. The company said that it expects to keep both Mint.com and Quicken online, which also has desktop application as well as the Web interface.

The deal is expected to close during the fourth quarter, pending regulatory review.

Minty Success Story

“Mint.com brings a wealth of experience in creating and building innovative, easy-to-use online products,” said Dan Maurer, senior vice president and general manager of Intuit’s Consumer Group, in a statement.

Intuit plans to retain Patzer as general manager of Intuit’s personal finance group. Within half a year of launch, Mint.com attracted more than half a million users, the company said on its Web site.

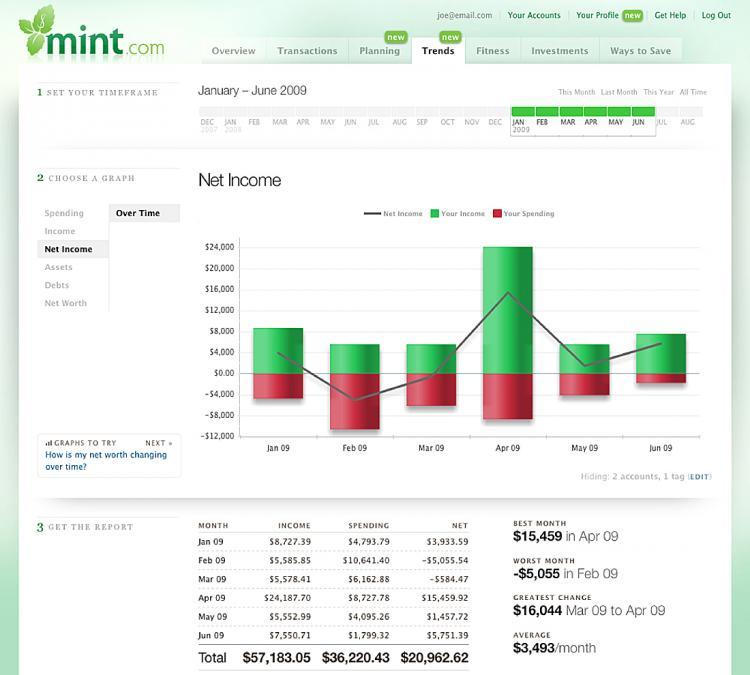

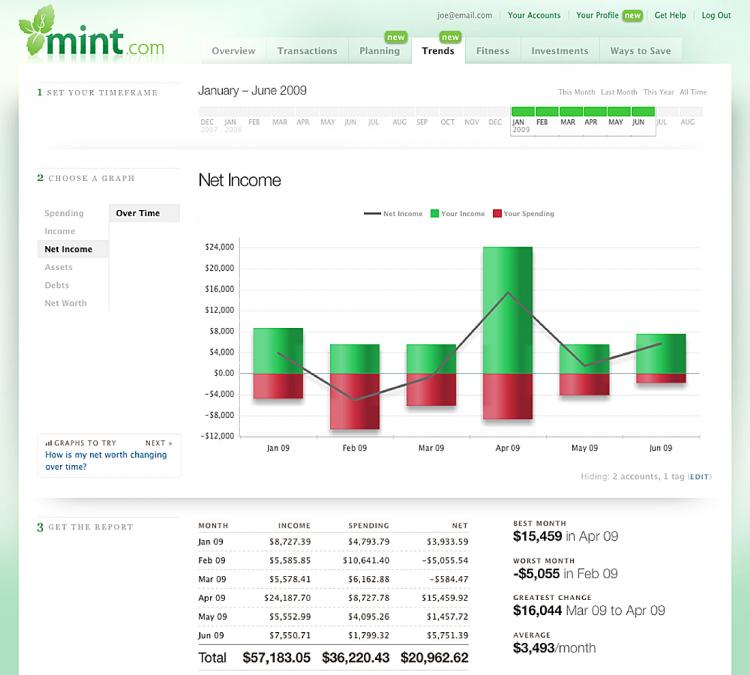

All Mint.com services are free, and users begin by completing a questionnaire and entering in their bank account, credit card, loans, mortgages, and other financial account information.

The service generates revenues by partnering with financial services providers and recommending to users (via sales leads) ways in which they can save or further their money.

From its inception, Mint.com has obtained more than $17 million in venture capital backing, the company said. Investors include Benchmark Capital, Shasta Ventures, and First Round Capital.

Both companies are based in Mountain View, California.