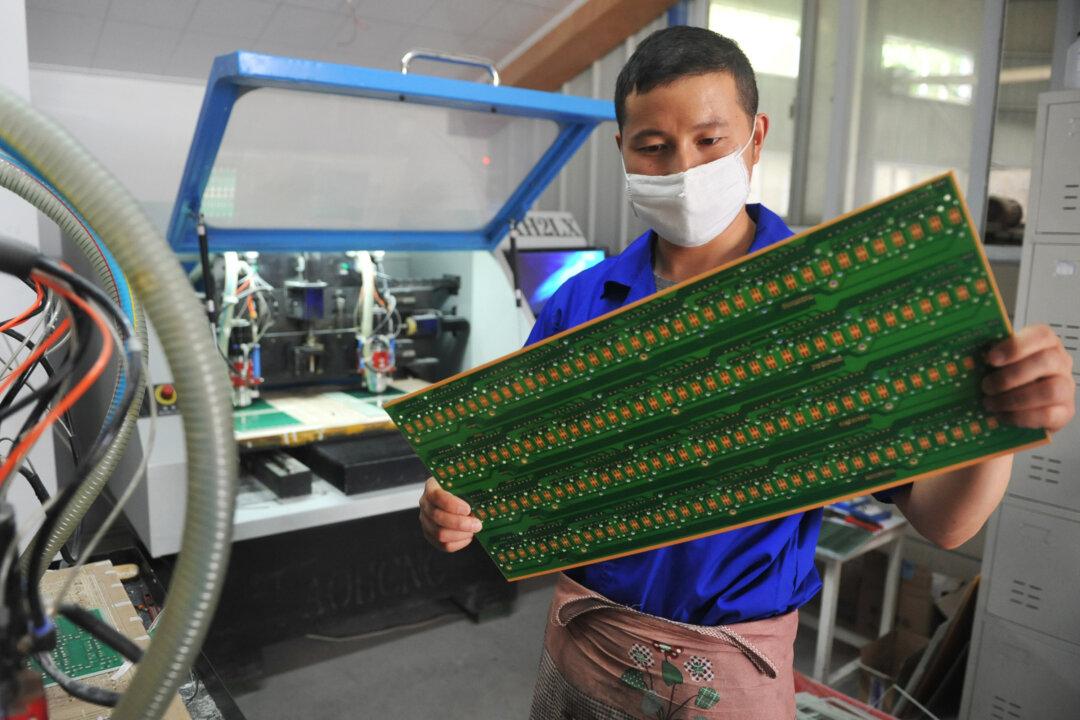

With Chinese tech giants Huawei and ZTE both sanctioned by U.S. authorities and prevented from doing business with U.S. suppliers, it’s become apparent—since the companies’ business operations have suffered as a result—that China’s semiconductor industry isn’t advanced enough to meet domestic demands.

According to Chinese customs data, the country imports as much as $300 billion worth of semiconductors annually, making it the largest import category by value.