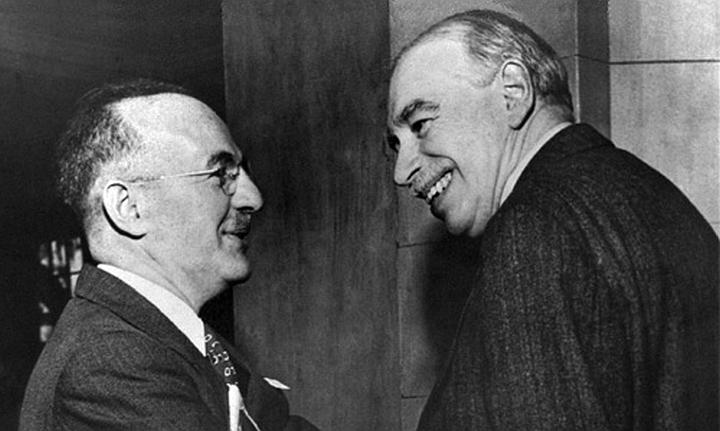

Retired political economist Paul Davidson poses a question with his latest book: “Who’s Afraid of John Maynard Keynes?“

One need not be afraid of Keynes, since he died in 1946. However, the promotion of Keynes’s ideas, as exhibited in this book, deserves condemnation. Out in late 2017 and subtitled “Challenging Economic Governance in an Age of Growing Inequality,” it takes the cake for incoherence, dishonesty, and grammatical errors.

Even worse, “Who’s Afraid” pushes totalitarianism with Keynesian rationale:

- wage controls;

- price controls;

- capital controls;

- an end to free trade;

- profit-margin limits;

- mandated foreign aid;

- a vast central-bank mandate;

- a worldwide monopoly on currency exchange.

If that doesn’t scare you, the book calls for government deficits as deep and as far as the eye can see. This is in line with modern monetary theory, a popular way to fund the proposed Green New Deal and other socialist pet projects.

Davidson’s key Keynesian assertion is that unemployment occurs from insufficient aggregate demand. He then blames this on people who don’t immediately spend their earnings on consumption goods.

Apparently, saving is a problem because it doesn’t stimulate demand. Governments must step in and spend beyond their means, so goes the logic, to raise aggregate demand and achieve full employment.

This is odd, since profligate spenders such as Argentina and Venezuela suffer from crippling unemployment, as well as out-of-control inflation that’s estimated by the Troubled Currencies Project at 39 percent and 2,198 percent, respectively. Meanwhile, Singaporeans have saved nearly half of their incomes for a generation and enjoy high living standards and low unemployment: below 2.5 percent for the decade prior to 2020.

The cartoonish and dangerous view of “Who’s Afraid” is the end of the road for Keynesianism. The author is a devoted Keynesian disciple and the founder and past editor of the Journal of Post Keynesian Economics, which began in 1978.