Hauling in Large Paychecks

Windfall profits and hoarding the company’s cash were responsible for median base salaries and bonuses increasing by 17 percent in 2010.

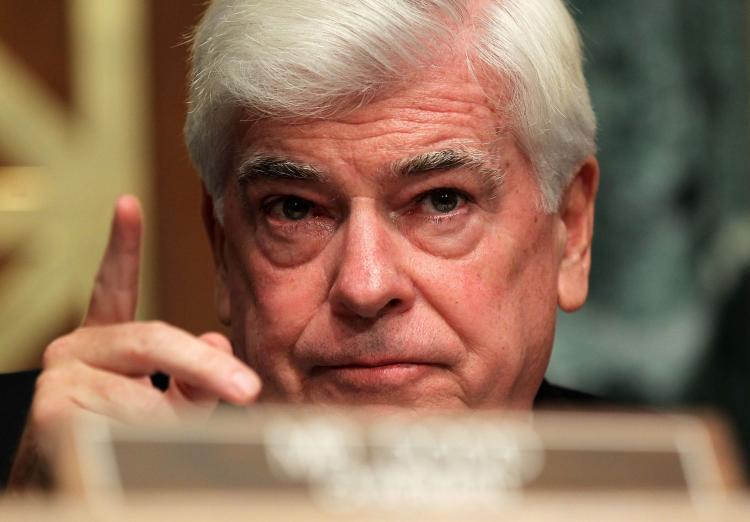

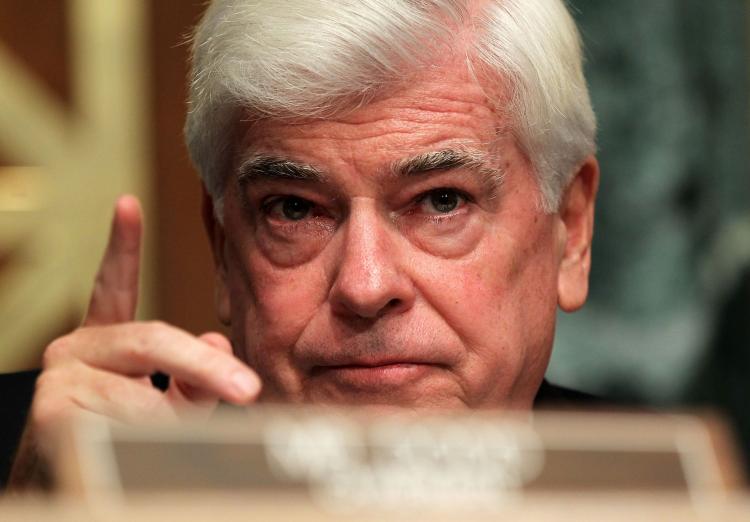

FOCUSING ON THE BIG PAYCHECK: Committee Chairman Sen. Christopher Dodd (D-Conn.) speaks during a hearing before the Senate Banking, Housing, and Urban Affairs Committee Sept. 30, 2010, on Capitol Hill. The hearing was to focus on the Dodd-Frank Wall Street Reform and Consumer Protection Act. Alex Wong/ Getty Images

|Updated: