In its first financial update since undergoing bankruptcy, General Motors Co. said on Monday that it lost $1.15 billion during the third quarter, but generated more than $3.3 billion in cash and aims to repay its government loans starting in December.

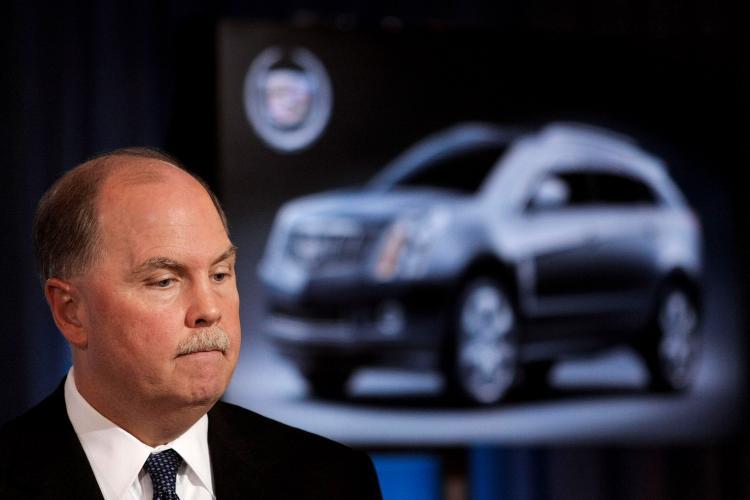

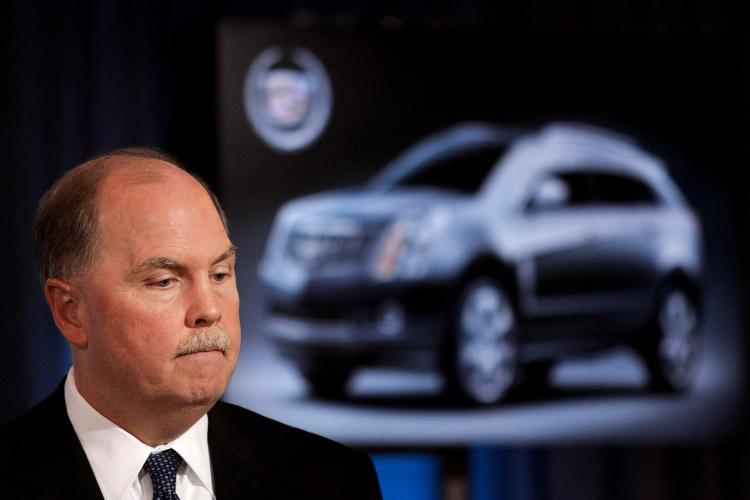

“We have significantly more work to do, but today’s results provide evidence of the solid foundation we’re building for the new GM,” said CEO Fritz Henderson in a statement.

The company posted sales of $28 billion during the third quarter, and its global market share increased 0.3 percentage points to 11.9 percent at the end of the quarter. GM also reduced its unsold vehicle inventory by 158,000 units to 424,000 vehicles.

In October, GM saw its first year-over-year increase in monthly sales in almost 2 years, by posting a modest 4.7 percent increase in vehicles sold. Its U.S. market share also climbed to nearly 21 percent.

The results were an encouraging sign that GM’s restructuring efforts are off to a good start.

“We have improved our cost structure and cleaned up our balance sheet. Our debt burden has been lowered, and our liquidity is much improved,” said GM Chairman Edward Whitacre in a speech delivered at Texas Lutheran University last week publicized on its Web site. “So, we are getting into fighting shape. We are not there yet, but we are definitely on our way.”

But most importantly, Whitacre said that the company is focusing on customers and building vehicles that are responsive to customer demand. GM is now focusing only on its four core brands: Cadillac, Buick, Chevrolet, and GMC.

“In August, two weeks after we unveiled plans for a new Buick crossover, we canceled it,” Whitacre said. “Public reaction… from employees, dealers, media and most importantly, from our customers… was clearly unfavorable to it.”

“So, we listened and we moved on,” he added.

During the quarter, GM increased its available cash by $3.3 billion to $42.6 billion. It plans to repay the U.S. and Canadian governments early, stating next month with a $1.2 billion payment and every quarter thereafter. The company has also begun to repay the German government for its loans extended to Opel, GM’s European operations.

Analysts viewed the announcement favorably. Compared to last year’s $2.5 billion loss in the third quarter, GM has come a long way.

“The numbers are encouraging,” Maryann Keller, president of Maryann Keller & Associates, said on Bloomberg TV. “What it demonstrates is that the government gave GM a reorganized balance sheet that made them more competitive.”

GM expects to fully repay its $6.7 billion in U.S. government loans by 2011, more than four years earlier than required, according to reports. The U.S. Treasury originally required the loans to be repaid by 2015.

The company received almost $50 billion in public aid since last year, but most of the debt has been converted into stock, with the U.S. government now a 61 percent owner of the company.

Earlier this month, GM leadership abruptly canceled a planned sale of its European operations Adam Opel GmbH and Vauxhall Motors to an investor group led by Canada’s Magna International. Instead, the company is raising capital to keep its European business.

Now, the German government may be unwilling to give the 4.5 billion euros (US$6.6 billion) in state aid it once promised to Opel, leaving GM to pony up the funds necessary to keep GM Europe running.

“We’re going to be needing to participate directly in the financing“ of Opel, Chris Preuss, GM Vice President of Global Communications said in an interview with the National Post. ”The taxpayers of both Canada and the U.S. have a stake in this. But what was agreed upon was that we have to be able to run a global business.”

And it’s not just Europe. GM recently announced a $293 million joint-venture in China and has plans to sell more vehicles in China, where its Buick brand is catching up with consumers. Another $300 million was recently invested in a new transmission plant in Mexico.

Such moves raise the question of whether U.S. and Canadian governments would allow GM to use their bailout money to fund and protect jobs overseas. From GM’s perspective, the company believes that running a profitable business globally will drive up shareholder value.

The U.S. and Canadian governments are now the biggest shareholders of the company.

“We have significantly more work to do, but today’s results provide evidence of the solid foundation we’re building for the new GM,” said CEO Fritz Henderson in a statement.

The company posted sales of $28 billion during the third quarter, and its global market share increased 0.3 percentage points to 11.9 percent at the end of the quarter. GM also reduced its unsold vehicle inventory by 158,000 units to 424,000 vehicles.

In October, GM saw its first year-over-year increase in monthly sales in almost 2 years, by posting a modest 4.7 percent increase in vehicles sold. Its U.S. market share also climbed to nearly 21 percent.

The results were an encouraging sign that GM’s restructuring efforts are off to a good start.

“We have improved our cost structure and cleaned up our balance sheet. Our debt burden has been lowered, and our liquidity is much improved,” said GM Chairman Edward Whitacre in a speech delivered at Texas Lutheran University last week publicized on its Web site. “So, we are getting into fighting shape. We are not there yet, but we are definitely on our way.”

But most importantly, Whitacre said that the company is focusing on customers and building vehicles that are responsive to customer demand. GM is now focusing only on its four core brands: Cadillac, Buick, Chevrolet, and GMC.

“In August, two weeks after we unveiled plans for a new Buick crossover, we canceled it,” Whitacre said. “Public reaction… from employees, dealers, media and most importantly, from our customers… was clearly unfavorable to it.”

“So, we listened and we moved on,” he added.

During the quarter, GM increased its available cash by $3.3 billion to $42.6 billion. It plans to repay the U.S. and Canadian governments early, stating next month with a $1.2 billion payment and every quarter thereafter. The company has also begun to repay the German government for its loans extended to Opel, GM’s European operations.

Analysts viewed the announcement favorably. Compared to last year’s $2.5 billion loss in the third quarter, GM has come a long way.

“The numbers are encouraging,” Maryann Keller, president of Maryann Keller & Associates, said on Bloomberg TV. “What it demonstrates is that the government gave GM a reorganized balance sheet that made them more competitive.”

Four Years Ahead of Schedule

GM expects to fully repay its $6.7 billion in U.S. government loans by 2011, more than four years earlier than required, according to reports. The U.S. Treasury originally required the loans to be repaid by 2015.

The company received almost $50 billion in public aid since last year, but most of the debt has been converted into stock, with the U.S. government now a 61 percent owner of the company.

Diverting Taxpayer Funds Overseas?

Earlier this month, GM leadership abruptly canceled a planned sale of its European operations Adam Opel GmbH and Vauxhall Motors to an investor group led by Canada’s Magna International. Instead, the company is raising capital to keep its European business.

Now, the German government may be unwilling to give the 4.5 billion euros (US$6.6 billion) in state aid it once promised to Opel, leaving GM to pony up the funds necessary to keep GM Europe running.

“We’re going to be needing to participate directly in the financing“ of Opel, Chris Preuss, GM Vice President of Global Communications said in an interview with the National Post. ”The taxpayers of both Canada and the U.S. have a stake in this. But what was agreed upon was that we have to be able to run a global business.”

And it’s not just Europe. GM recently announced a $293 million joint-venture in China and has plans to sell more vehicles in China, where its Buick brand is catching up with consumers. Another $300 million was recently invested in a new transmission plant in Mexico.

Such moves raise the question of whether U.S. and Canadian governments would allow GM to use their bailout money to fund and protect jobs overseas. From GM’s perspective, the company believes that running a profitable business globally will drive up shareholder value.

The U.S. and Canadian governments are now the biggest shareholders of the company.