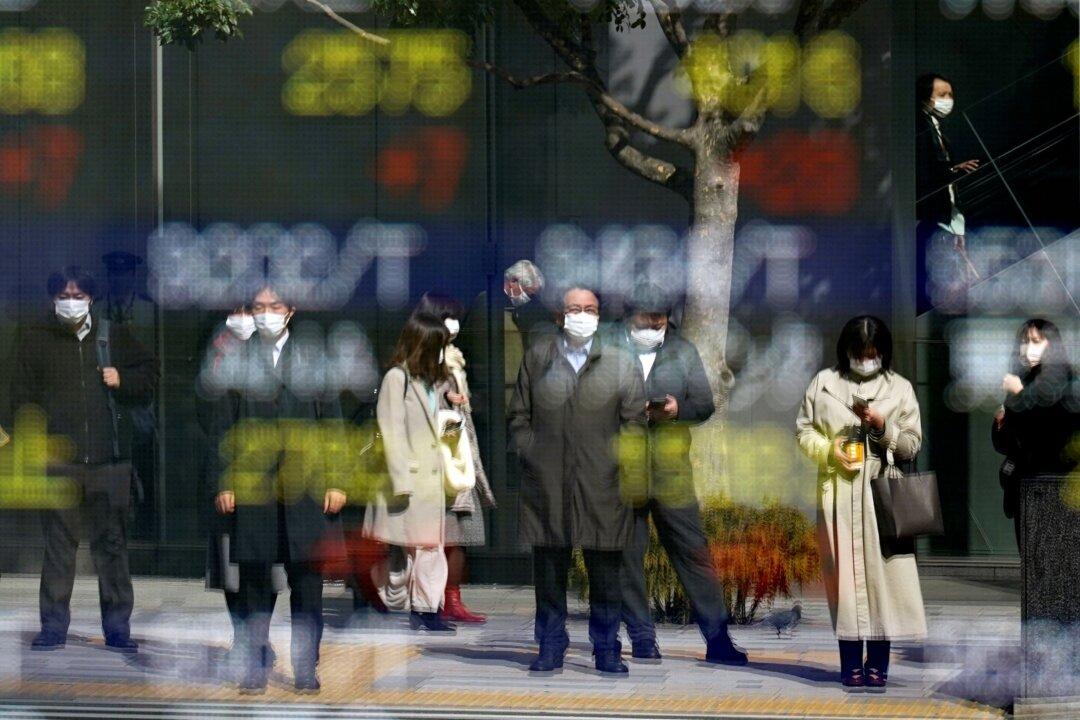

BEIJING—Global stock markets advanced Friday after a Federal Reserve official raised hopes the U.S. central bank might not step up its anti-inflation fight as much as feared.

London, Shanghai, Frankfurt, and Tokyo gained. Oil prices edged higher.

BEIJING—Global stock markets advanced Friday after a Federal Reserve official raised hopes the U.S. central bank might not step up its anti-inflation fight as much as feared.

London, Shanghai, Frankfurt, and Tokyo gained. Oil prices edged higher.