[ G20 Summit Concludes in Seoul, Holds off on Specifics -NTDTV ]

The G-20 (Group of 20 nations) summit in Korea ended last weekend with major, albeit narrow, accords in principle among the world leaders regarding currency exchange and financial regulations.The G-20 nations reached a deal that major global economies would agree to common standards, in principle, that would help flag trouble spots in national economies, but stopped short of developing details around the framework.

The Seoul Action Plan, as it is called, will help shape common monetary and exchange rate policies, trade and development policies, fiscal policies, global financial reforms, and structural reforms.

A group of finance ministers—including the U.S.’s Ben Bernanke—as well as the International Monetary Fund will hash out the details over the next several months.

The agreement capped a sometimes-divided two-day affair in which little real progress was made regarding trade imbalance and currency valuation. The United States also left empty-handed over a much-anticipated trade agreement with host nation South Korea.

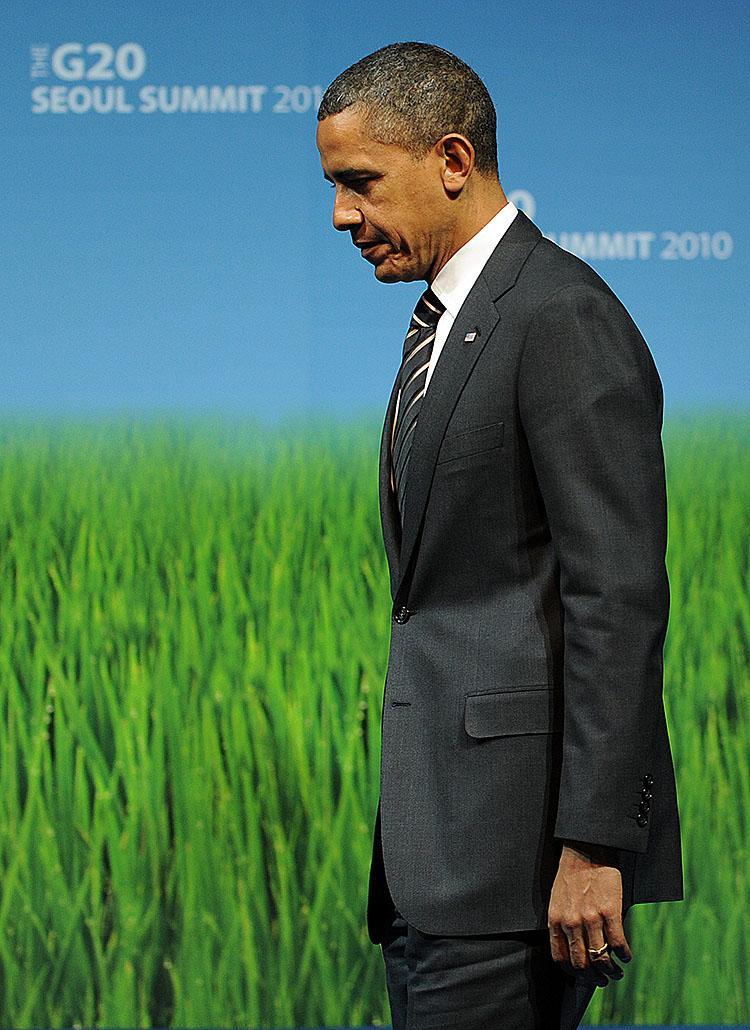

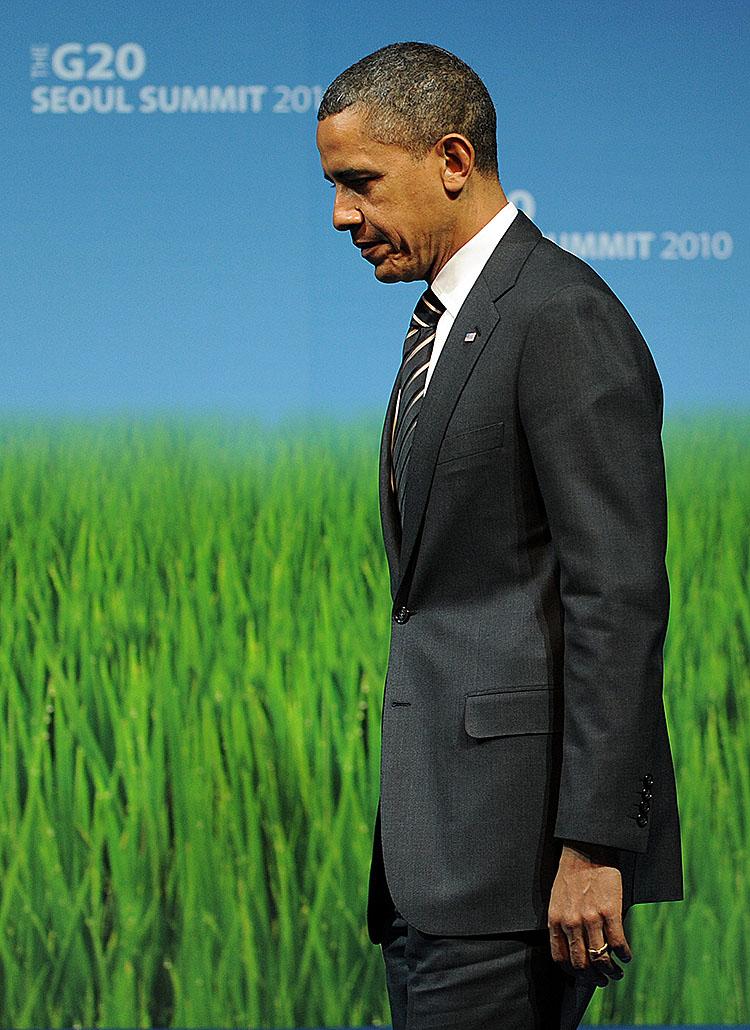

Calling the agreement a “work in progress,” according to a press statement issued by the White House, Obama left Korea saying that much remains to be done.

But other world leaders were quick to hail the agreement as a step in cooperation. “Cohesion and cooperation defined the G-20 during the crisis,” said Dominique Strauss-Kahn, International Monetary Fund director, in a statement. “Now the challenge is to secure the recovery and to create the growth and jobs that the world needs.”

No Backing of U.S. Currency Agenda

The common action plan is generally viewed as less potent on currency exchange and trade surplus as President Barack Obama had hoped going into the G-20 summit, which began last Thursday.

President Obama hoped that the summit would be a launch pad to promote more currency flexibility by the Chinese, whose cheap currency is widely believed to be contributing to the U.S.’s massive trade deficit with China due to the relative cheapness of Chinese products.