Real Estate Professionals and Volunteers Working to Forestall Foreclosures

May was the third month in a row when the number of foreclosures in the U.S. surpassed 300,000, according to RealtyTrac.

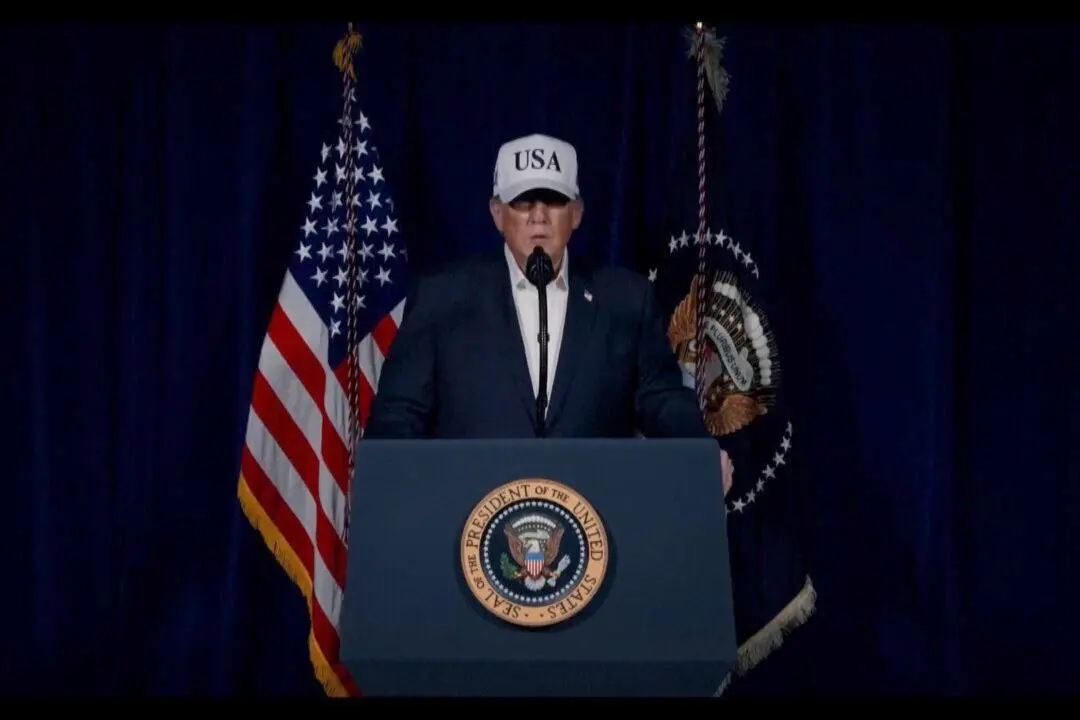

HELPING HOMEOWNERS: Fairfax County Chairwoman Sharon Bulova speaking on June 27 at the Foreclosure Prevention Fair at the Ernst Community Cultural Center on Annandale campus of Northern Virginia Community College. This event was hosted by the DC Metro chapter of Asian Real Estate Association of America (AREAA).

|Updated: