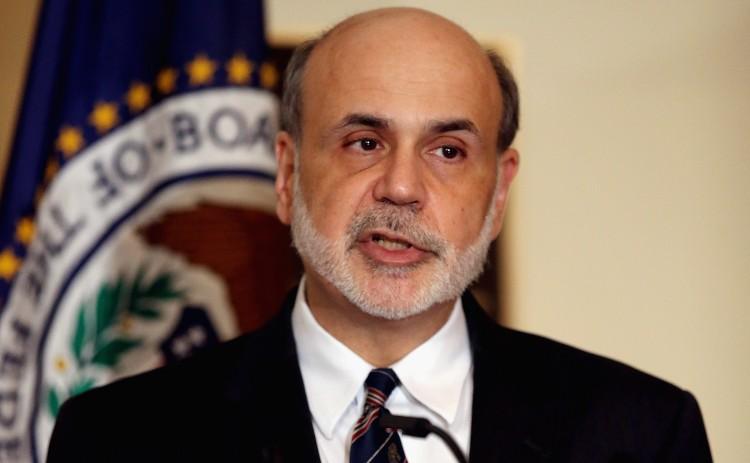

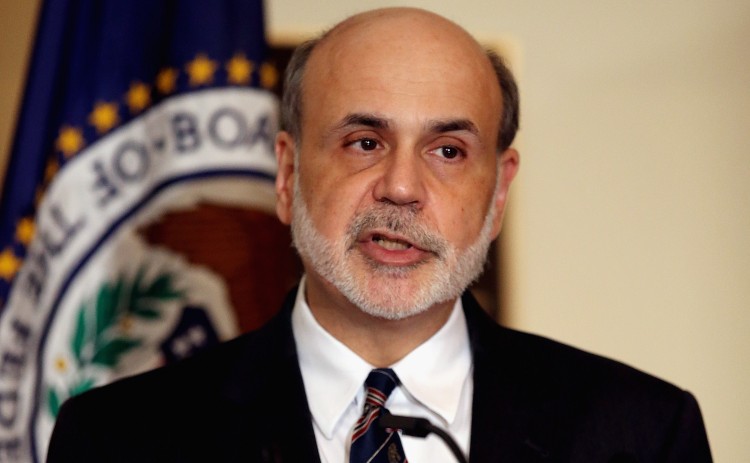

The Kansas City Federal Reserve bank will host its annual Economic Symposium Conference Friday in Jackson Hole, Wyo. Global central bankers, finance ministers, and capital markets veterans usually attend the event, which was first held in 1978. The topic then was World Agricultural Trade: The Potential for Growth, much different from this year’s keynote speech title “Monetary Policy Since the Crisis,” which Fed chairman Ben Bernanke will give at 10 a.m. EDT and which is usually cleared at the same time for release to the public.

Until a few years ago, this annual symposium of finance veterans and academics was not as widely followed as it is today. Market participants began following the event after Ben Bernanke preannounced a second round of debt monetization dubbed “QE2” in 2010. In 2011 he again used the outing to hint at another form of monetary easing called Operation Twist. This is the reason why Jackson Hole is now marked red in the agendas of most people with an interest in monetary policy. Many analysts, however, do not expect further hints at easing this year, which could be drafted into policy at the Federal Open Market Committee meeting Sept. 12-13.

Mixed Data Forces Fed’s Hands

“We expect Bernanke will reiterate the Fed’s options for providing further stimulus, and its willingness to act ‘as needed,’ but not signal any specific policy action,” says a report by Stone & McCarthy Research Associates. The analysts believe that economic data, which was slightly better than expected does not give the Fed the reason it needs to act right now. The report also mentions that the setup for 2010 was different, as the next FOMC meeting was three weeks after Jackson Hole as opposed to 2012. The 2010 September FOMC meeting also did not include an update of the economic situation, but this year’s will. This gives Bernanke less room to maneuver, according to Stone & McCarthy. They believe that a further deterioration in Europe could prompt the Fed to act, but that this will also be at a later stage.

Analysts from Credit Suisse and Goldman Sachs expect a similar outcome: “Jackson Hole as the venue for some of the most important announcements in the recent policy history of the Fed (remember QE2?), [but] Bernanke has more often than not been loath to make any type of strong commitment,” says a report by Credit Suisse. Goldman Sachs further dampens the enthusiasm in a piece of research: “While we expect his speech to be consistent with a high probability that Fed officials will ease monetary policy further, this would not add much new information following the very dovish FOMC minutes released last week.”

In fact, nonvoting FOMC member Bullard said on CNBC that given stronger economic data since the last FOMC meeting, he was “not sure” if this data is enough of a reason for renewed stimulus and the Fed’s own Beige Book, which was released Wednesday, confirms this stance: “Reports from the twelve Federal Reserve Districts suggest economic activity continued to expand gradually in July and early August across most regions and sectors.”

The Epoch Times publishes in 35 countries and in 19 languages. Subscribe to our e-newsletter.