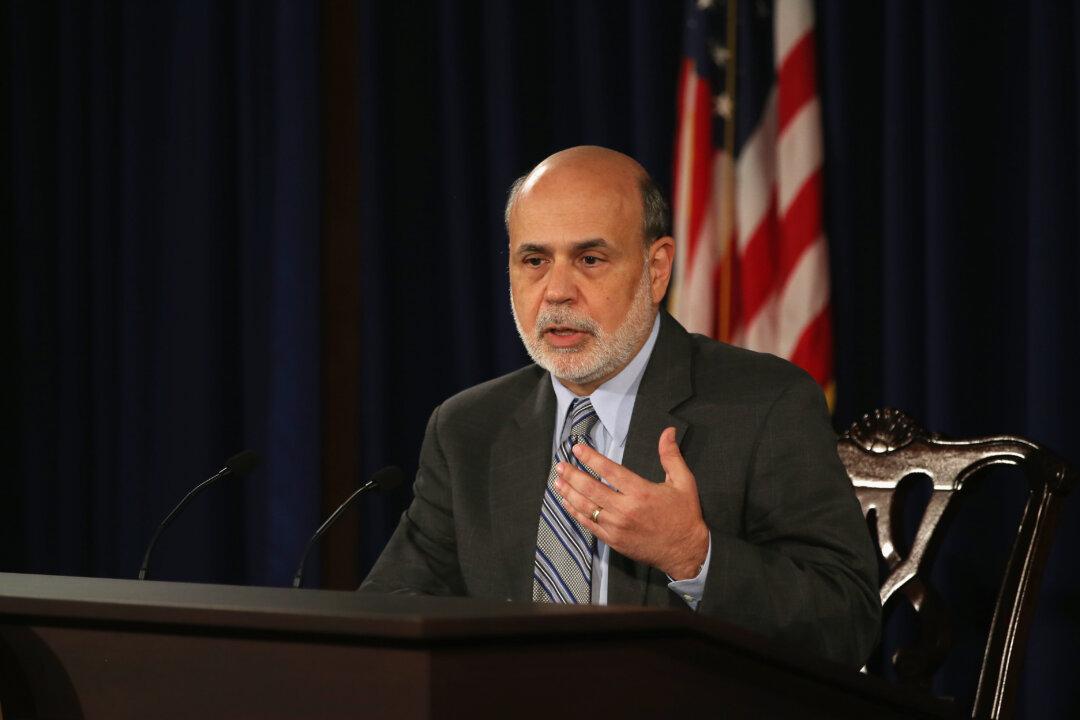

Canada’s housing market should get a boost after U.S. Federal Reserve chairman Ben Bernanke announced that there would be no “tapering” of bond purchases on Sept. 18.

Expectations had been building since May that the Federal Open Market Committee (FOMC) would announce at their September meeting a reduction (“taper”) in the $85 billion a month of U.S. Treasury and mortgage-backed securities the Fed had been purchasing.

No tapering was a real shocker to financial markets. Not only did Bernanke seemingly de-emphasize the role of the U.S. unemployment rate and up the focus on inflation and the broader economic outlook, he also downgraded the 2013-14 growth and inflation projections.

To make a long story short, the FOMC is concerned about tighter financial conditions—mainly the sharp rise in U.S. mortgage rates that threatens to derail the housing recovery. In addition, fiscal retrenchment entered the picture as a partial U.S. government shutdown is possible after the end of the month as well as another battle over the country’s borrowing limit—the debt ceiling.

In reaction, the U.S. five-year bond yield fell 0.22 percent (22 basis points) in the week ending Sept. 20. This week, as of Tuesday, the yield has moved 7 bps lower as Fed speakers have, on balance, reaffirmed the FOMC statement.

The Canadian five-year bond yield followed suit, falling 0.2 percent from it’s level on Sept. 16, as of Tuesday, Sept. 24.

Although Canadian mortgage rates have been expected to rise gradually going forward, that rise has hit a snag. While the big banks may be slow to adjust their mortgage rates lower, they certainly can afford to not increase them and still maintain or increase profitability margins.

The five-year fixed mortgage rates of the six big Canadian banks on Sept. 17 averaged 4.13 percent. As of Sept. 24, the average has yet to change.

Pre-approved home buyers had been locking in mortgages in anticipation of the impending rise in rates, but it would seem they’ve been given some more time. With lower mortgage rates, houses are more affordable.

This rush to lock in mortgage rates has been cited by market analysts as spearheading the recent rises in monthly sales and home price increases. Should mortgage rates not rise, or should they even fall, then monthly sales, home prices, and affordability should all improve.

Policymakers in Canada, like many market participants, would likely have also been surprised by the FOMC’s decision, which could reignite housing bubble fears for the most conservative among them.

If the Fed were to have begun tapering bond purchases, Canadian bond yields would have followed U.S. Treasury bond yields and moved higher, and mortgage rates in Canada would subsequently rise. Then the housing market would cool.

Canadian policymakers could actually have had the FOMC give them a helping hand. But now, there might be more work for them to do.