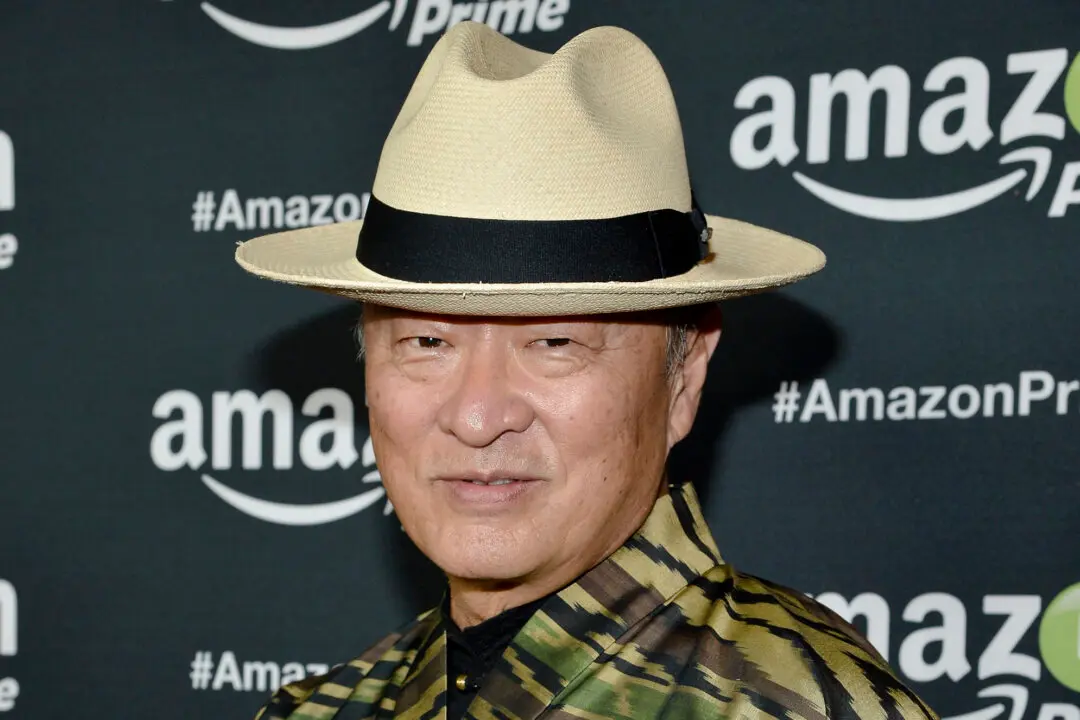

George Lucas, creator of the “Star Wars” and “Indiana Jones” franchises, has backed The Walt Disney Company’s chief executive officer, Bob Iger, amid the proxy battle waged by activist investors for seats on the company’s board.

“Creating magic is not for amateurs,” Mr. Lucas said in a statement, per CNBC, voicing his support for Disney’s current directors.