Disney Acquires Marvel Entertainment for $4 Billion

Walt Disney Co. Inc. will take over Marvel Entertainment Inc. in a cash and stock deal valued around $4 billion.

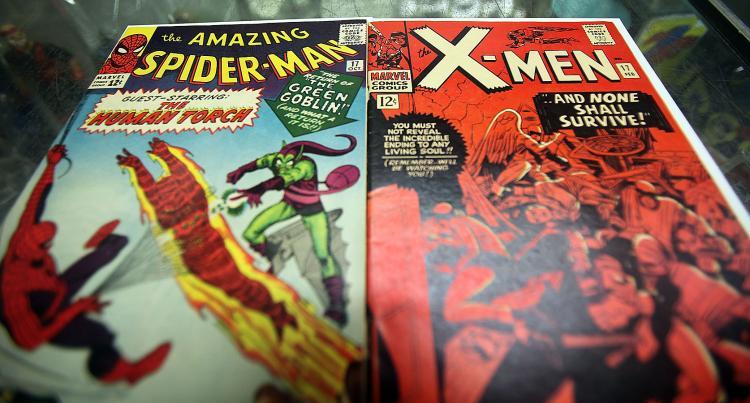

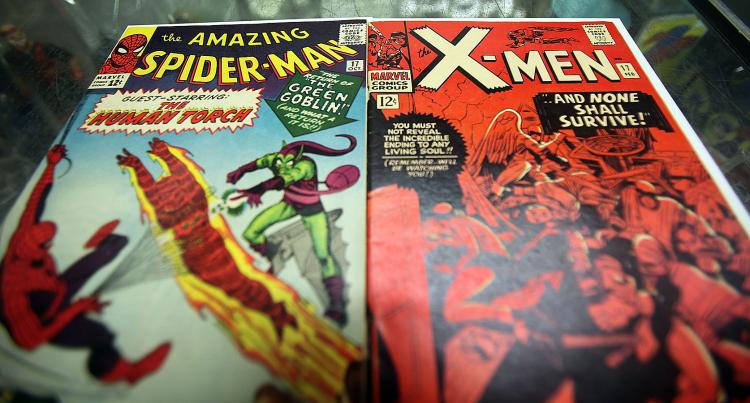

Walt Disney Co. announced that it will acquire Marvel Entertainment Inc. for $4 billion in stock and cash, bringing 5,000 Marvel characters including Spider Man and Incredible Hulk under the Disney umbrella. Mario Tama/Getty Images

|Updated: