Businesses in the United States are set to face a bigger federal tax burden in 2023 due to Democrat policies and the phasing out of Republican tax overhauls, combined with an expected raise in corporate minimum tax for billion-dollar companies.

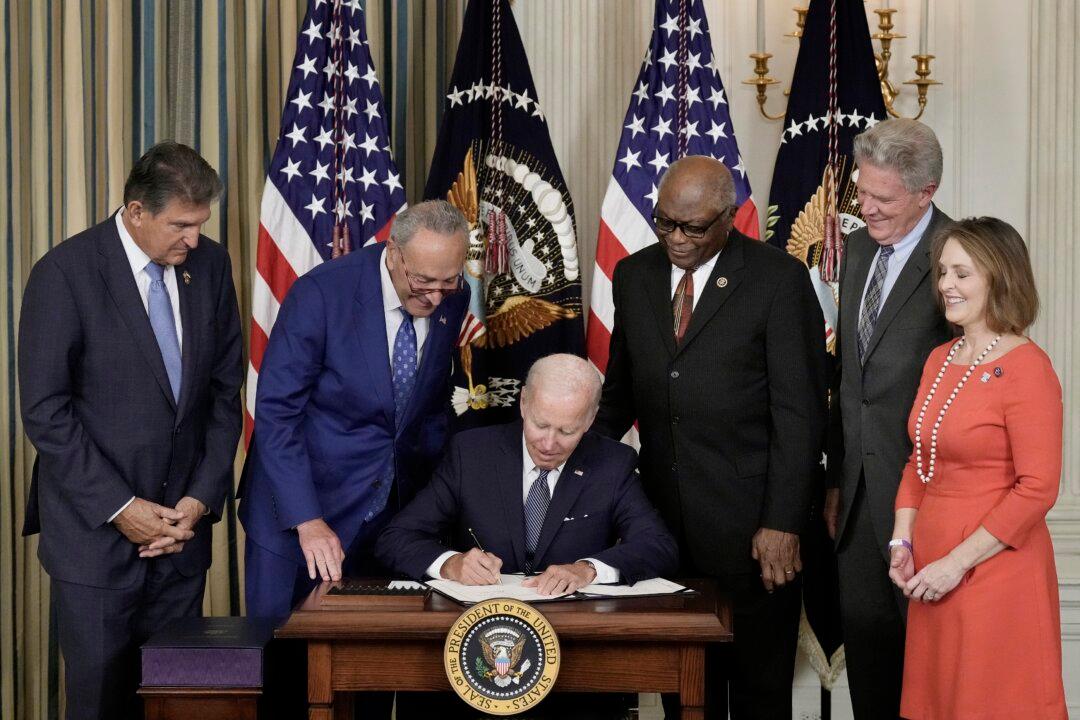

The Inflation Reduction Act (IRA) included several changes due to which businesses will face higher taxes. In addition, some of the temporary provisions in the 2017 Tax Cuts and Jobs Act (TCJA) enacted under the Trump administration are set to get phased out in 2023. The Joint Committee on Taxation estimates that the total effect of these two developments would result in additional tax increases of $115 billion for businesses.