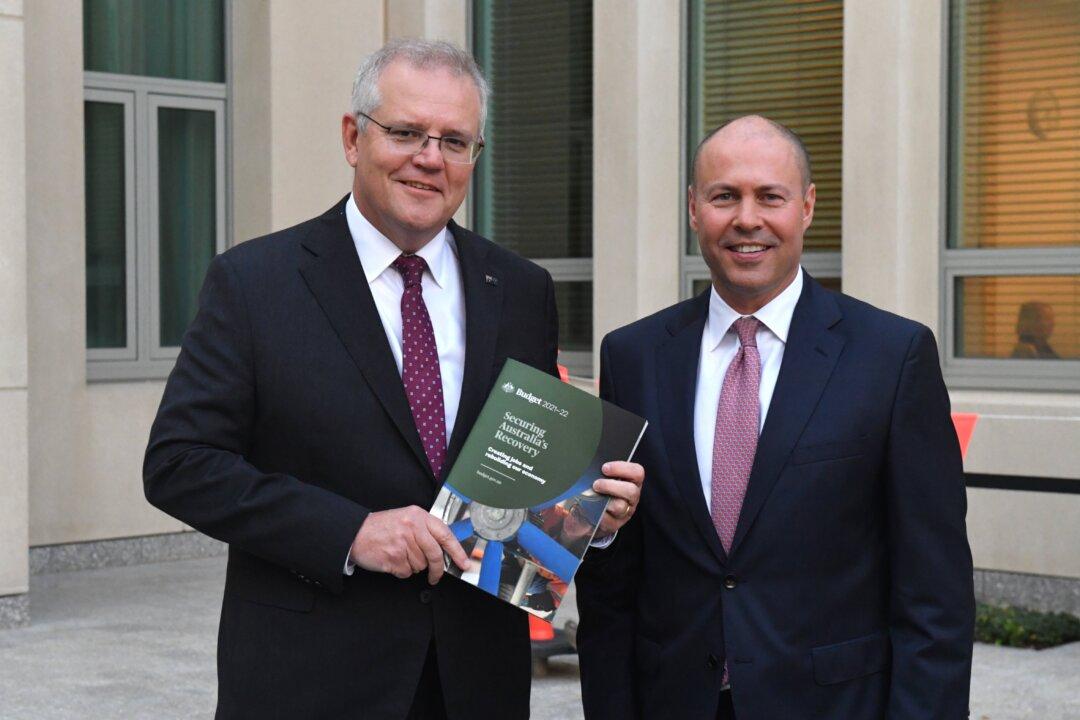

Australian Treasurer Josh Frydenberg announced a spending bonanza in Tuesday night’s budget speech, signalling a complete shift by the normally fiscally conservative Coalition government.

Frydenberg has defended the budget, which allocates billions across most sectors of society, manifesting in the form of tax breaks, job training programs, and boosting of critical services. It also precedes the next federal election, which is due between August and May next year.