News Analysis

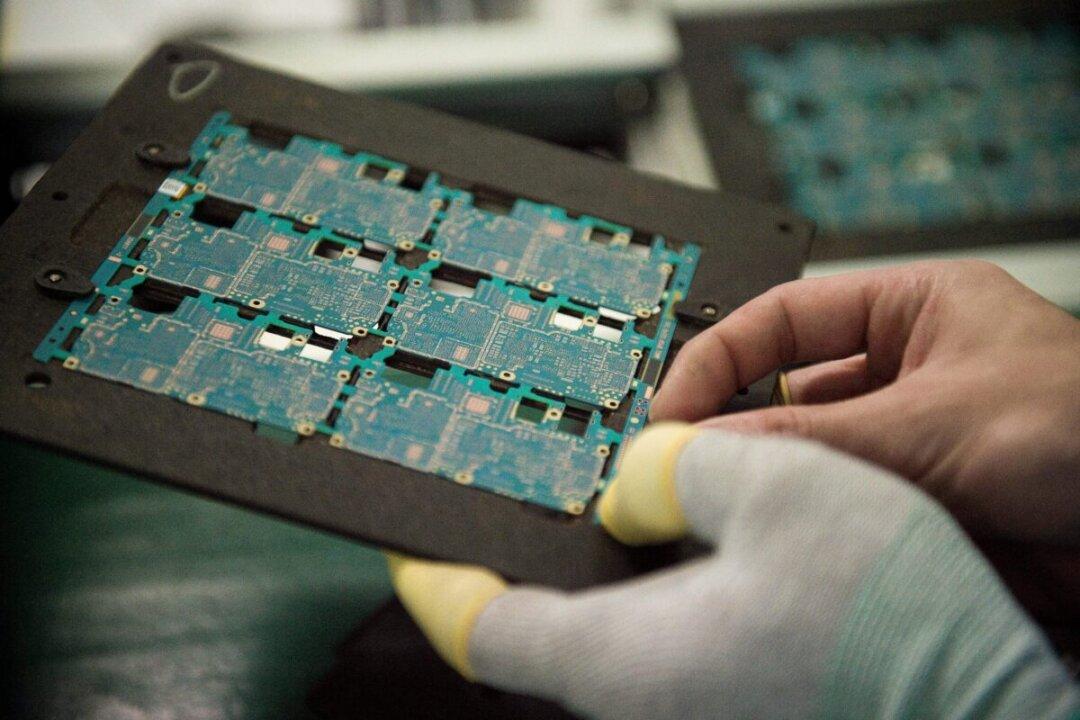

It appears China’s national chipmaking campaign is coming to an end, with huge investments drained and key figures in the semiconductor industry arrested recently.

It appears China’s national chipmaking campaign is coming to an end, with huge investments drained and key figures in the semiconductor industry arrested recently.