Corporate Tax Debate Heating Up

The debate about corporate tax rates is heating up, with one side claiming that corporate tax cuts would put Americans back to work, and the other side insisting that such breaks don’t create jobs and will put Americans out of work.

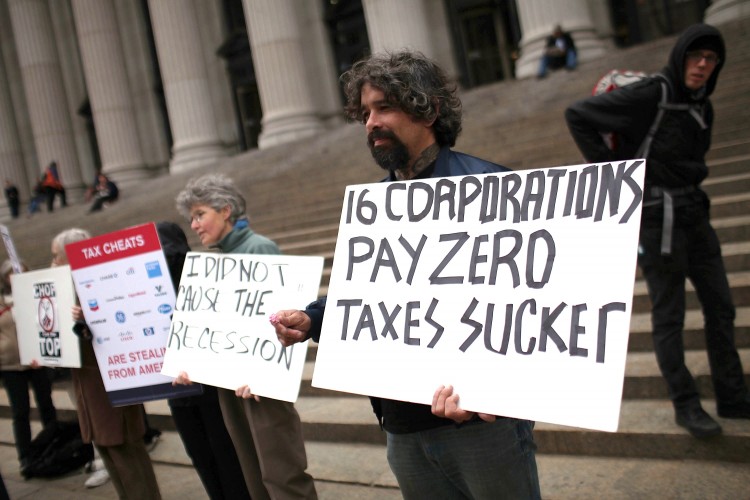

TAXES DEBATED: Protesters against American corporate tax loopholes demonstrate outside of the James A. Farley Main Post Office this past April in NYC. Citizens for Tax Justice analyzed 12 of America's Fortune 500 companies and found that 10 paid no taxe Spencer Platt/Getty Images

|Updated: