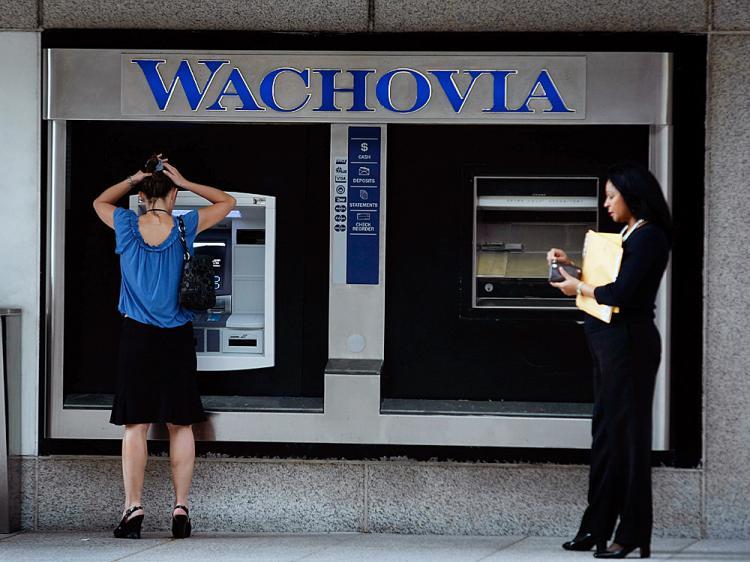

Citi Buys Wachovia Assets

Citigroup Inc. agreed to purchase Wachovia’s banking operations and assets in an all stock deal valued at $2.16 billion.

People use an ATM at a Wachovia bank branch September 29, 2008 in Miami, Florida. Joe Raedle/Getty Images

|Updated: