In recent years Chinese state-owned enterprises (SOEs) have made inroads in expanding overseas, but little has been known about their financial returns. Recent reports say that most of them are showing huge losses, with mismanagement and corruption high on a list of reasons.

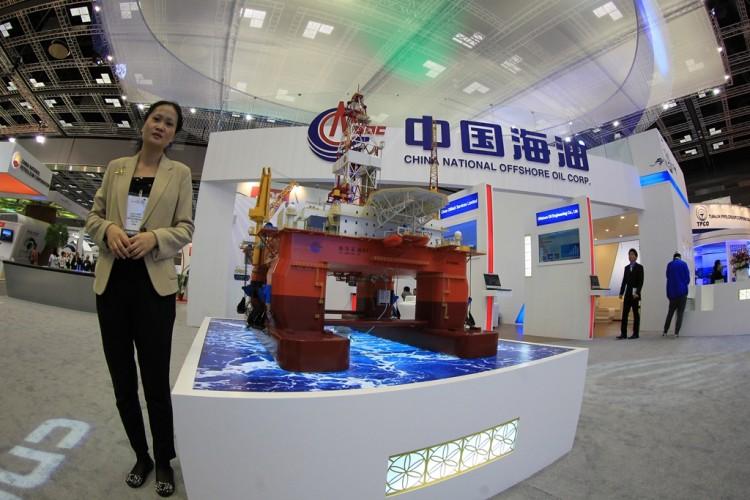

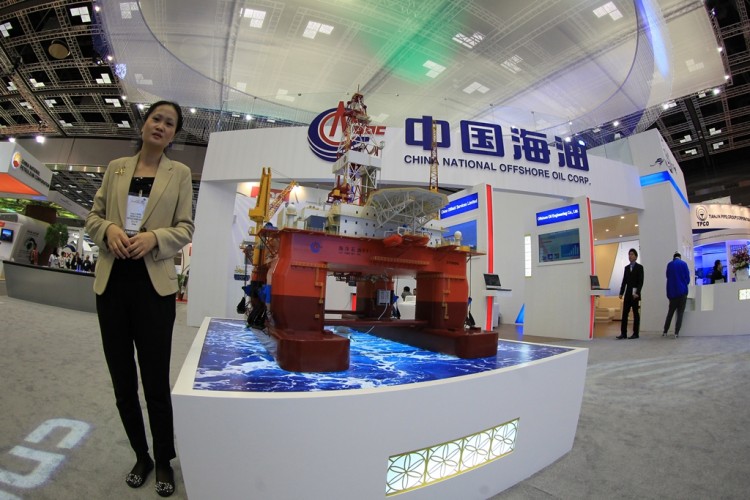

China’s three big petroleum companies--China National Petroleum Corporation (CNPC), ranked 6th among 2011 Fortune Global 500 companies; China Petrochemical Corporation, also known as Sinopec Group, ranked 5th among 2011 Fortune Global 500 companies; and China National Offshore Oil Corporation (CNOOC)--hold an industry monopoly and are hugely profitable enterprises in China. The third quarter financial reports by CNPC and Sinopec showed that their average daily earnings are about US$95 millions.

Yet their overseas projects are mostly a loss.

According to a midlevel official of the State Council’s Asset Supervision and Administration Commission (SASAC), the petroleum corporations’ overseas petroleum and natural gas exploration projects show a large loss, China Times said in a Dec. 30, 2011 report.

“It’s really difficult for overseas subsidiaries to perform well and show good results; most of their overseas projects are a loss,” another official, who works at an overseas department of one of the three state-owned petroleum companies, said.

Hong Kong economist Larry Lang also commented on this topic during his leaked closed-door speech in Shenyang last October (when he predicted the impending collapse of China’s economy). Lang said CNPC made a successful US$2 per barrel bid on an oil [exploration] project in southern Iraq. However, wages, equipment, and other expenses resulted in a per barrel production cost of $4 to $5, which means for every barrel sold, CNPC will have a loss of at least $2.

According to statistical data from China’s Petroleum and Chemical Industry Association, the three big petroleum companies were involved in 144 overseas projects as of the end of 2010, with a total investment of close to US$70 billion.

A 2010 report by China Petroleum University said that more than two thirds of overseas projects by the three big petroleum companies showed financial losses due to “a different management system and international investment environment.”

Industry-wide Losses

According to information gathered by The Epoch Times, many SOEs have incurred financial losses in overseas projects in recent years.

A 2007 report by China’s Ministry of Commerce said 65 percent of overseas investments had lost money.

In 2008, CITIC invested in an iron ore project in Australia. Eventually this resulted in financial losses of about US$2 billions.

In a 2009 project in Mecca, Saudi Arabia, China Railway Construction Corporation (CRCC) lost approximately US$600 million.

A July 4, 2010 report by China Times said that during the 2008 financial crisis 68 SOEs reported a total of US$11.4 billion in losses.

Graft, Lavish Spending

A Dec. 2010 Guangdong News report said embezzlement, risky investments, and “lavish and irresponsible spending by overseas company personnel” are to blame for some of the losses.

“Some [personnel] fled with large amount of money while working overseas, and some simply deposited public funds into private accounts. Unapproved high-risk speculative investments led to huge losses. Bad delegation and unsuitable assignments of overseas work team resulted in missing funds,” the report said. http://finance.qq.com/a/20101208/001334_1.htm

The official from SASAC told China Times that after several years of investigation they have but a sketchy picture of the overseas SOEs. These enterprises remain the main culprits of state-owned asset losses.

Chinese economist Liao Cheng told The Epoch Times that the so-called overseas branches of many state-owned enterprises have become the channel for high-ranking officials to funnel money to their personal overseas bank accounts. Moreover, these officials earn huge commissions on overseas investments.

Economist Qi Yanchen told New Epoch Weekly that some state-owned enterprises deliberately “lose” money in their investments in order for their officials to be able to “fish for profit” for themselves.

Additionally, oversight and monitoring of overseas investment is extremely difficult. “There has not been a single audit report on overseas investment by the State Audit Administration,” Qi said.

Last June, SASAC issued two sets of oversight measures: “Interim Measures for the Supervision and Administration of Central Overseas State-Owned Assets of Central State-Owned Enterprises” and “Interim Measures for the Administration of Overseas Property Rights of State-Owned Enterprises.”

It was an initial attempt to control the 4 trillion yuan (US$634 billion) overseas investment loophole drain.

The “measures” did not specify any punishment of those responsible for the losses.