Chinese Regime Gorges on US Debt

China increased its holdings by buying $7.3 billion dollars of U.S. public debt in May, the U.S. Treasury announced Monday.

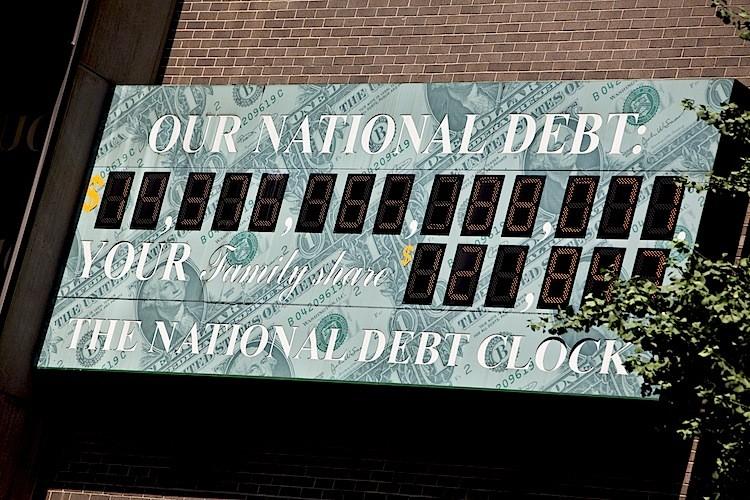

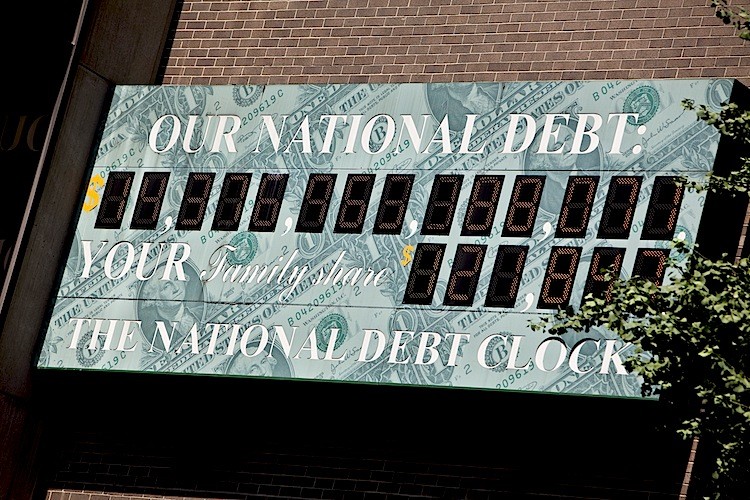

The U.S. National Debt Clock billboard is displayed on a building on Sixth Ave. in midtown Manhattan on July 11, 2011 in the New York City. Ramin Talaie/Getty Images

|Updated: