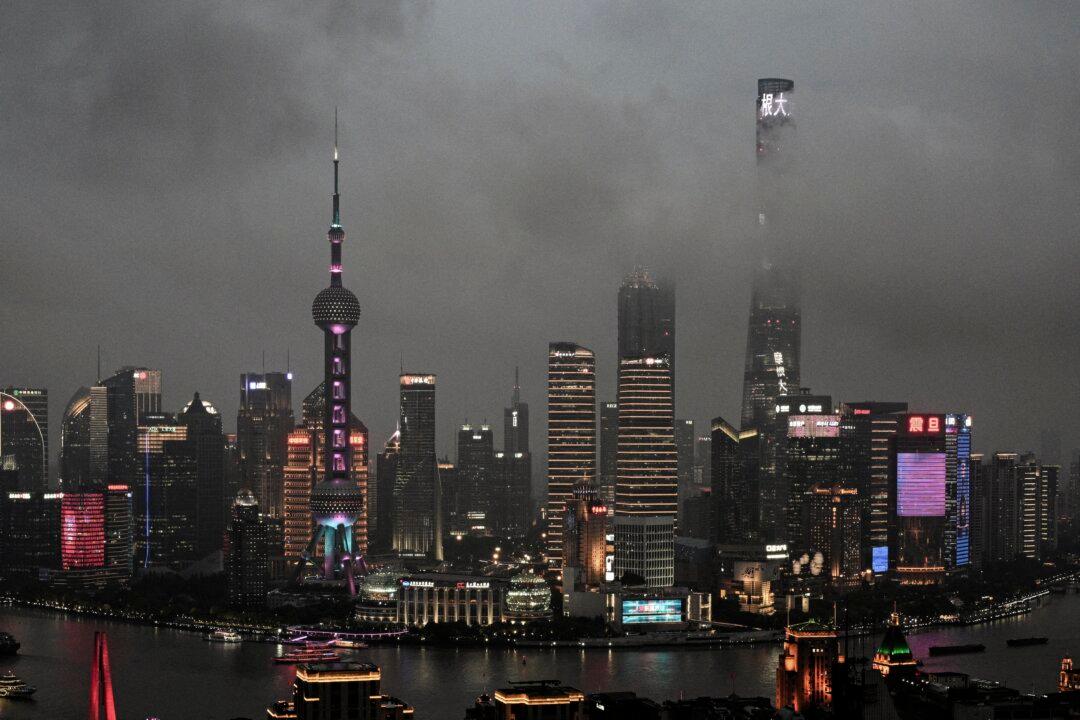

The World Bank has cut China’s growth forecast as the world’s second-largest economy faces multiple issues, ranging from ongoing property crisis to weakening domestic demand and deflation, which is dragging down the economy.

The report, released on Oct. 1, lowered China’s gross domestic product growth forecast for 2024 to 4.4 percent, down from 4.8 percent in its April forecast.