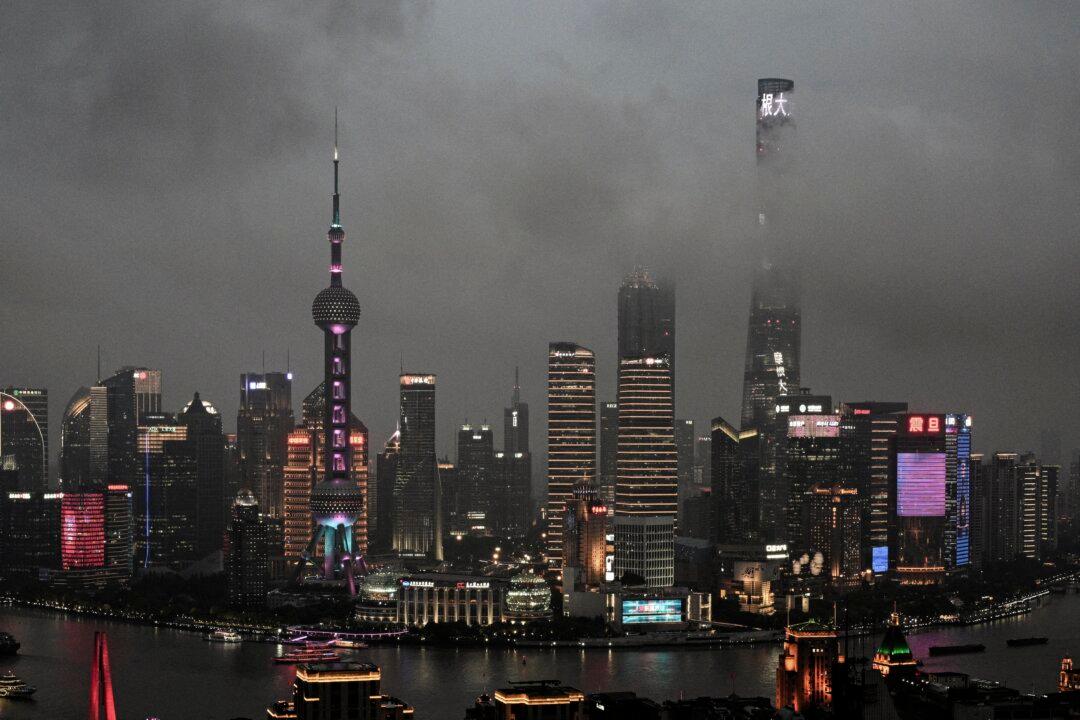

The majority of British companies in China express pessimism about the business outlook in the world’s second-largest economy. Despite China lifting all COVID restrictions since late last year, many challenges and uncertainties persist, contributing to this negative sentiment.

According to a survey by the British Chamber of Commerce in China published on Dec. 12, 60 percent of British firms said that doing business this year in China is harder than last year, with many delaying their investment. “Among the 60 percent of businesses that found doing business harder, 78 percent of these attributed this increase in difficulty to economic factors.”