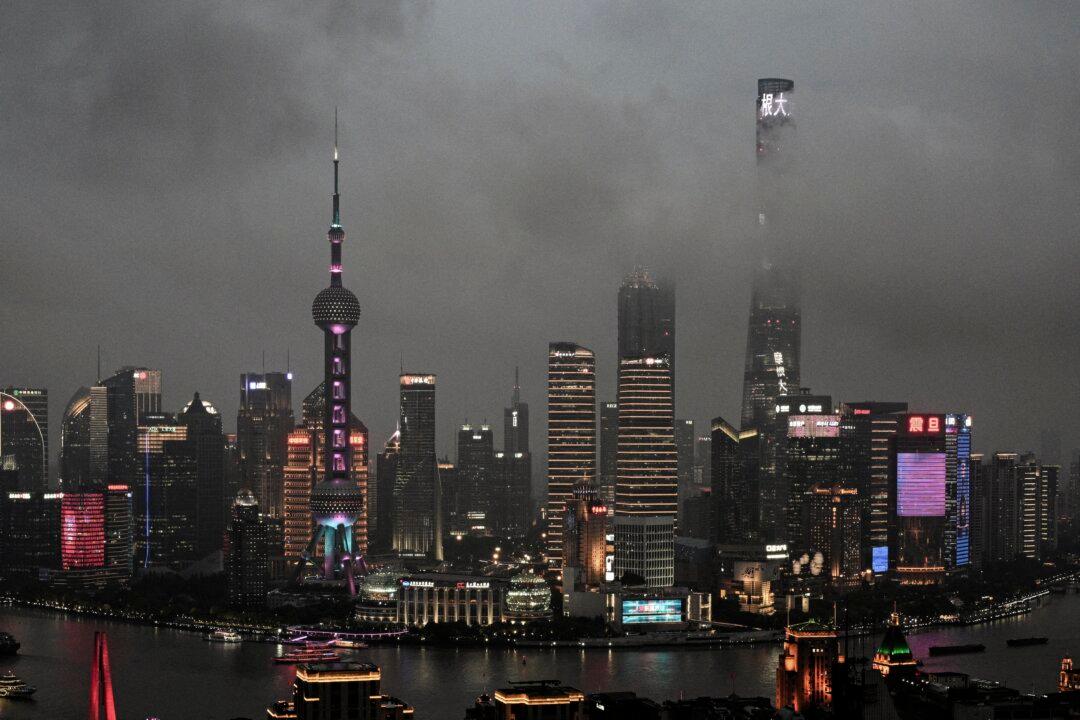

The cancellation of China Evergrande’s debt restructuring plan of its offshore bonds could “lead to the uncontrolled collapse” of the company and cause “a catastrophic effect” on other embattled companies in the industry, its investors warned on Oct. 9, according to The Wall Street Journal.

The Chinese real estate giant has been working with creditors on the debt restructuring plan for the last two years after it defaulted in 2021, which triggered China’s property crisis.