News Analysis

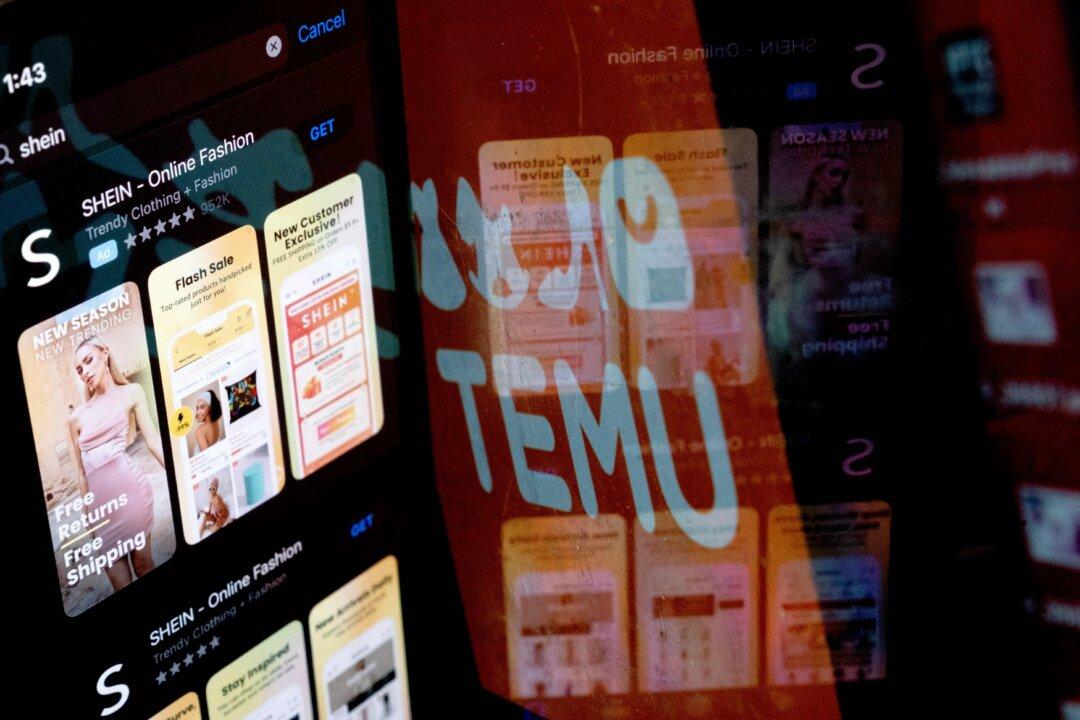

Chinese e-commerce company Pinduoduo’s cross-border platform Temu is expanding rapidly worldwide, especially in the U.S. market. However, Temu’s future is uncertain in the United States due to security concerns and growing tension between Washington and Beijing.