China’s real economic growth in 2025 was as low as 2.5 percent, only half the Chinese regime’s official number, according to the latest report by a U.S. think tank.

Analysts said the report’s estimate is closer to reality and that the real economic situation might even be worse.

China’s targeted gross domestic product (GDP) for 2025 was 5 percent. The growth rate for the third quarter announced by the Chinese communist regime was 5.2 percent.

“History offers no examples of economies that have recorded 5 percent real GDP growth while facing years of persistent deflation, as China has for ten consecutive quarters. We doubt China is the first,” Rhodium Group wrote.

The group’s estimate corresponds to a Chinese economist’s observation. Gao Shanwen, chief economist at Shenzhen-based SDIC Securities, said publicly at the end of 2024 that China’s actual GDP growth over the past two to three years was likely about 2 percent, which is much lower than the official figure of nearly 5 percent. He was banned from giving public speeches since then and recently resigned from the company.

U.S.-based independent economist Davy J. Wong told The Epoch Times that the Rhodium Group’s estimates can be seen as a reminder of conflicting methodologies, “reflecting not only discrepancies in growth data estimates but also differences in the interpretation of growth structure and data.”

“Rhodium’s core argument is not simply that growth is weak, but rather that there has been a greater decline in investment in the second half of the year, especially in fixed assets and real estate-related sectors. This conflicts with what the Chinese government is officially promoting,” he said.

Wong said Rhodium’s estimates illustrate that Beijing’s attempt to artificially boost the economy through investment using planned economy-style directives is unsustainable.

At the recent Chinese Communist Party’s (CCP) Central Economic Work Conference earlier this month, CCP leader Xi Jinping made the rare move of criticizing officials for “inflating data,” saying that the regime should “pursue genuine, unadulterated growth.”

Professor Frank Xie at the University of South Carolina Aiken School of Business told The Epoch Times on Dec. 23 that the CCP has always inflated its figures and that the real situation is likely one of continuous decline.

“The figure of 2.5 percent to 3 percent is an overestimate. I believe China’s true economic growth rate should be negative, because currently, only foreign trade is still holding up, while infrastructure investment and consumption are shrinking significantly. This makes it very difficult to sustain a 5 percent economic growth rate.”

The CCP’s latest official data show a comprehensive decline and slowdown of the Chinese economy.

From January to November, fixed asset investment decreased by 2.6 percent year-over-year, a further decrease from the 1.7 percent decline recorded from January to October. National real estate development investment decreased by 15.9 percent year-over-year, a larger decrease than the 14.7 percent decline from January to October, according to data released on Dec. 15 by the National Bureau of Statistics of China.

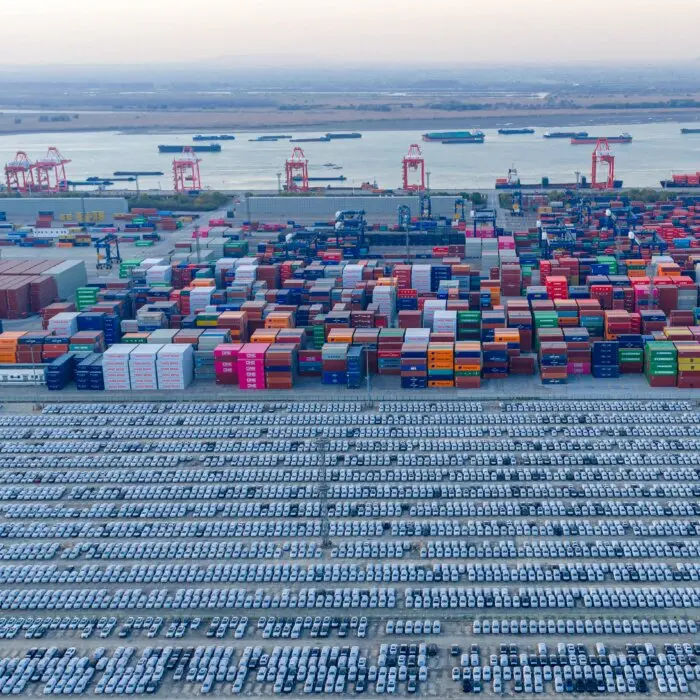

China’s actual utilized foreign investment in the first 11 months totaled 693.18 billion yuan ($98.6 billion), a decrease of 7.5 percent year-over-year.

The data also show a slowdown in several sectors: total retail sales of consumer goods, which increased by 1.3 percent year-over-year in November, lower than the 2.9 percent increase in October; industrial value added, which increased by 4.8 percent year-over-year in November, lower than the 4.9 percent increase in October; and average housing prices in 70 large and medium-sized cities, which decreased by 2.8 percent year-over-year in November, a larger decrease than the 2.6 percent decrease in October.

Dim Prospects for 2026

Rhodium Group also forecast in the report that China’s economic growth rate in 2026 will be only between 1 percent and 2.5 percent, far below the 4.5 percent growth rate projected by the International Monetary Fund (IMF).“The IMF’s statistics often focus on macroeconomic data, while Rhodium Group takes a more in-depth approach, examining economic structure, sustainable economic development, and the health of the market economy,” Wong said of the difference.

Businesses generally trust Rhodium Group’s investment analysis reports more, and private companies or multinational corporations typically don’t pay much attention to IMF reports, he said.

Xie said U.S. businesses will not base their investment decisions entirely on the data provided by the CCP or Rhodium Group.

“The trend of multinational corporations withdrawing from China continues, and investors are becoming increasingly pessimistic about China’s future prospects,” he said. “The CCP itself knows that it has shifted its export focus from Europe and the United States to Southeast Asia, Africa, and Latin America.”

Wong also believes that multinational corporations will be more cautious about investing in China, considering the uncertainties and risks.

“Foreign investors may withdraw from sectors in China that are currently experiencing overcapacity or are being sustained by subsidies,” he said.