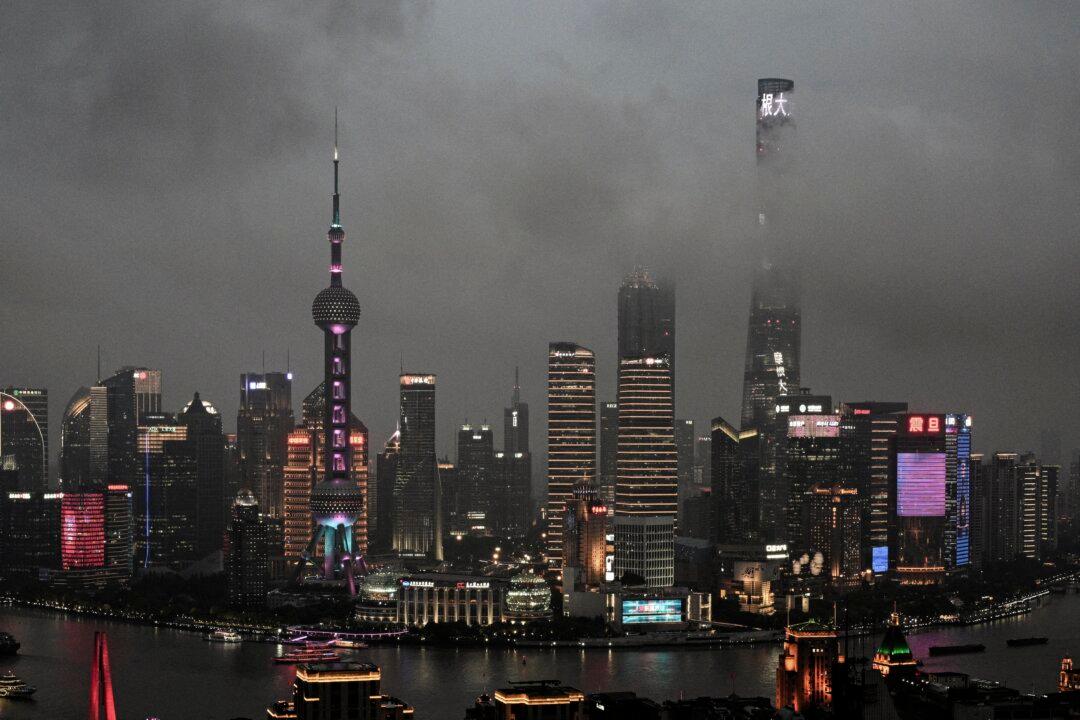

China’s manufacturing activity unexpectedly shrunk in October, according to state official survey data, a negative sign showing that the world’s second-biggest economy is facing a bumpy road to recovery.

China’s National Bureau of Statistics data, released on Oct. 31, showed that the manufacturing purchasing managers’ index (PMI) declined to 49.5 in October, compared with 50.2 in September.