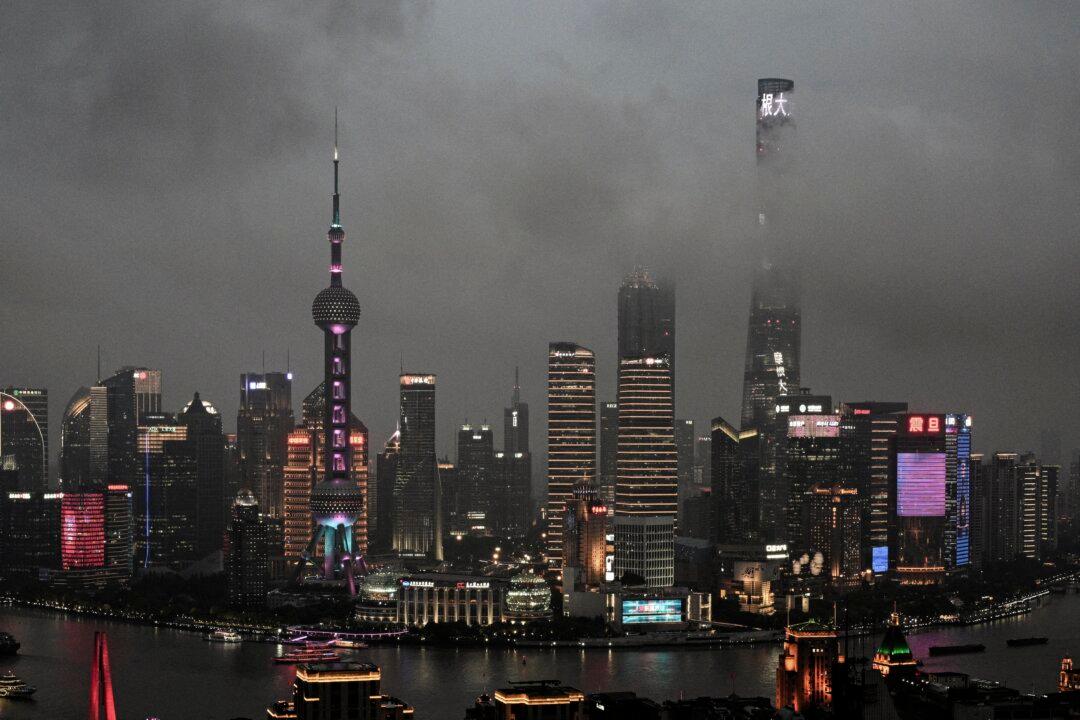

China has recorded its first quarterly foreign investment deficit since 1998, underscoring the trend that foreign companies are exiting the nation in response to economic challenges and geopolitical tensions.

Direct investment liabilities, a gauge of foreign direct investment (FDI), dropped by $11.8 billion in the third quarter, according to preliminary data published by China’s State Administration of Foreign Exchange on Nov. 3. It’s the first time China has suffered a shortfall in foreign investment since the bureau started recording data in 1998.