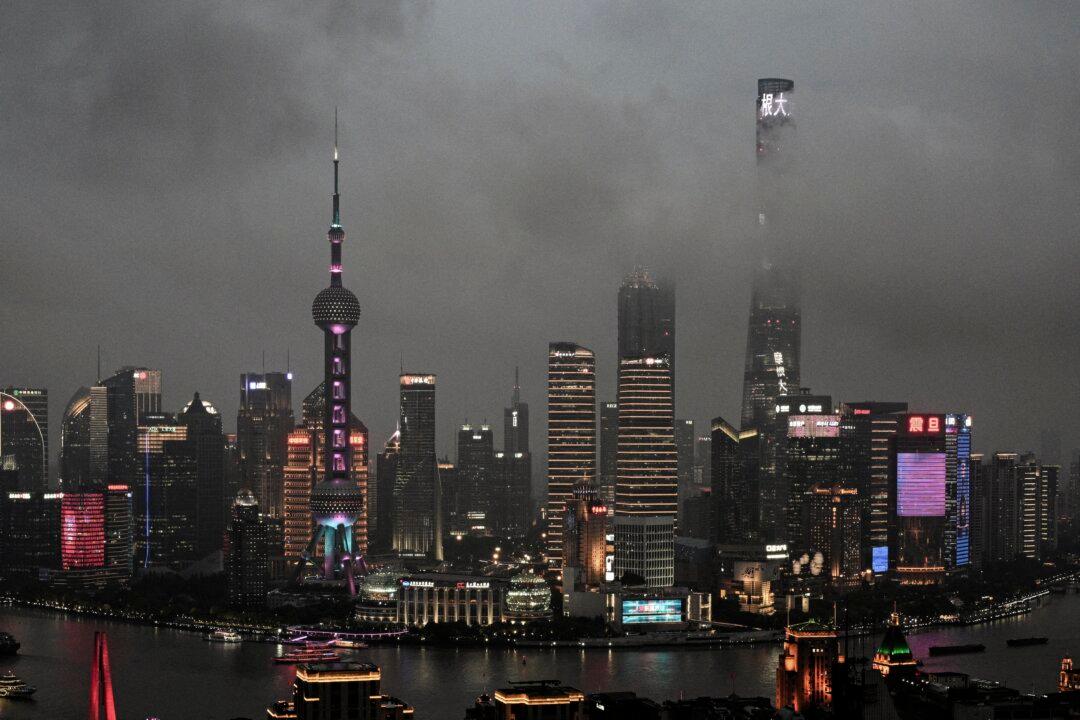

UK companies will face difficulties in doing business in China in the next five years because of multiple challenges despite Beijing’s policy measures, according to a UK trade group.

In its annual position paper released on May 21, the British Chamber of Commerce in China said Beijing’s policies to foster foreign investment after the COVID-19 pandemic lockdown since 2023 had not lifted the confidence among UK businesses in the country.