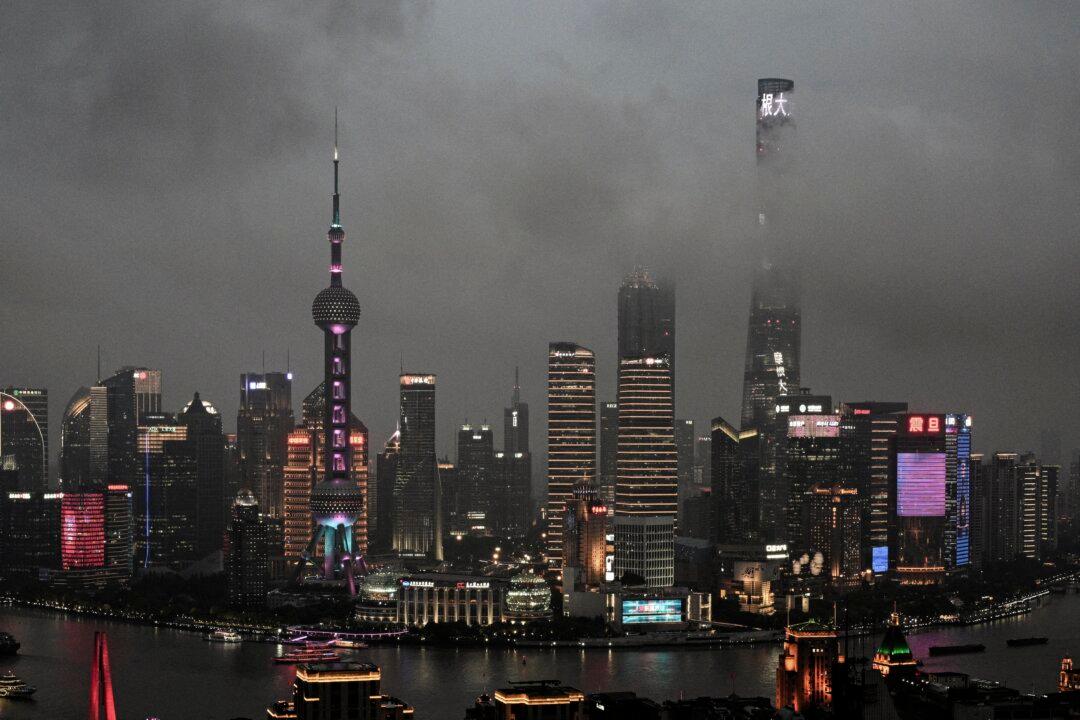

Sens. Bob Casey (D-Pa.) and Rick Scott (R-Fla.) on Nov. 9 introduced legislation that requires U.S. investment firms to disclose their private equity, hedge funds, and venture capital investments in foreign adversaries, such as China, in an effort to enhance transparency into how U.S. dollars are invested.

The bill, the “Disclosing Investments in Foreign Adversaries Act,” requires private investment funds to inform the Securities and Exchange Commission (SEC) annually of any investments in China and other “countries of concern,” including Iran, North Korea, and Russia.