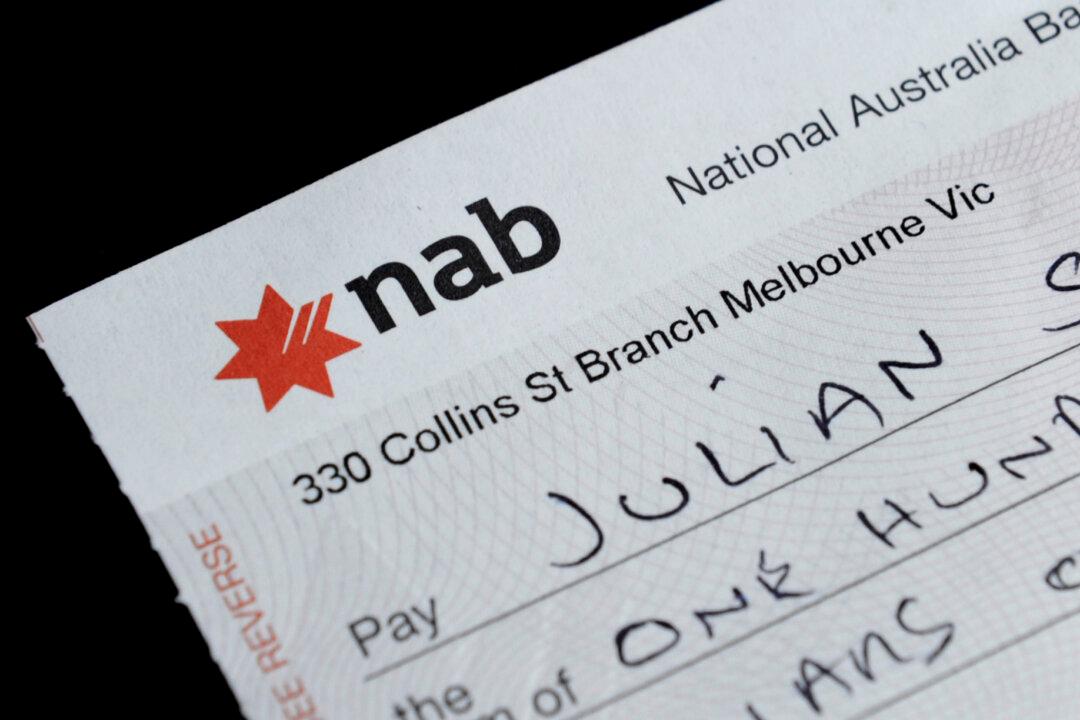

Australians will soon say goodbye to cheques as the federal government has introduced plans to abolish the paper-based payment system by 2030.

On June 7, the Australian government announced that it would completely phase out cheque usage no later than 2030 as part of a strategic plan to modernise the country’s payment system.